Investing In Gold For Beginners

Investing in gold is one of the most common and stable ways to safely invest and protect the value of your money over time. Gold investing offers investors a way to build their wealth steadily in the long run by simply allocating it in your portfolio.

Gold may be a solution to help protect your assets from inflation, a phenomenon that the global economy has been experiencing since the COVID-19 pandemic. The yellow precious metal can also hedge against market volatility and bring your portfolio some ease to short-term price swings.

There are some fundamental components beginner investors need to know about adding gold to their portfolios. If you’re wondering how to approach gold as an investment, this guide will help you navigate different strategies for being a long-term gold investor.

Best Reasons to Invest in Gold

Gold Protects the Value of Your Money

The number one reason why people invest in gold is to protect their money from losing value over time.

The primary use for gold as an investment is for wealth preservation.

Every asset has its role to play in an investment portfolio. Stocks are invested in for growth, bonds for defense and still today, gold remains a foundational asset in an investment portfolio for wealth preservation.

It is unlikely that people would put all of the money in gold in hopes of seeking outperformance. Rather, gold is a component in a balanced, diversified long-term invested portfolio. Taking a look at gold’s performance history compared to equities helps show its purpose.

Over a five-year period, the S&P 500 has returned about 14%. This shows how stocks represent long-term growth, and because of this, the asset class carries more risk. Taking a look at the SPDR Gold Trust ETF (GLD), its five year returns are about 5.5%.

While noticeably much different than the S&P 500’s performance over the same period, gold is a more stable asset that offers stability and protection against volatility. Volatility is tendency for market prices to change rapidly and unpredictably.

This means gold is a lower risk asset. The theory in this case is, lower risk means lower reward. This is an important trade off. As a result of this characteristic, investing in gold ensures your money retains its value over time.

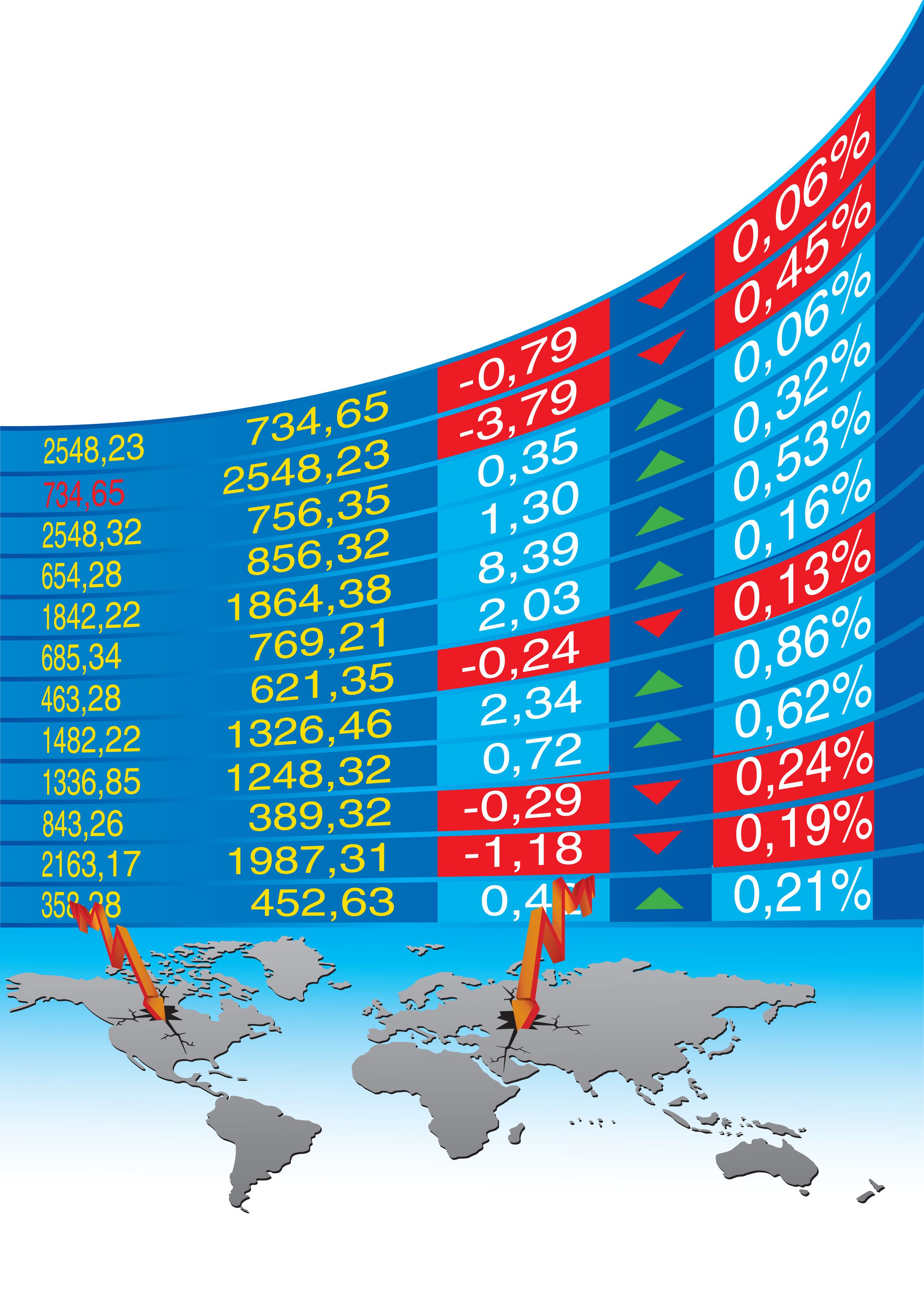

Global markets are subject to volatility.

Gold does not provide investors with income since it doesn’t have a dividend or interest rate. But this is not a disadvantage because that is not the purpose of gold. Gold is a wealth preserver and considered the standard for saving your cash against inflation.

Furthermore, as the price of gold increases in the long run, you can even secure a profit. Here is a breakdown of why you should consider investing in gold.

Gold Is the Preferred Inflation Hedge

Gold has served its purpose as a stable asset through both challenging and prosperous times.

One of the defining characteristics of the global economy in a post-pandemic era is rising inflation. Inflation is the gradual rise in prices of goods and services in an economy.

Another way to describe inflation is when money loses its purchasing power (so goods and services cost more). Inflation in the U.S. was recorded at 7% for 2021, the highest reading in more than 30 years.

In response to rising inflation the Federal Reserve is expected to raise interest rates in 2022. How is gold expected to respond in this scenario? Even though rising rates may not be the best case for gold, real rates are still in negative territory and inflation doesn’t show signs of dissipating.

Gold has intrinsic properties such as:

- scarcity

- the fact that it’s a physical asset

- its rarity, which gives it its monetary value

- a store of value, which makes it uniquely positioned to be the standard hedge against inflation

Central banks around the world influence how much money is circulating in the economy. The main way they do that is through interest rates. In response to the pandemic, central banks around the world lowered interest rates to stimulate the economy.

At the same time there has been a lot of money printing. This resulted in an increase in the money supply, which inevitably led to inflation. As a result, demand for precious metals is increasing.

In theory, when there is more money—compared to the supply of gold—circulating in the economy, the price of gold tends to increase. Inflation is the result of an increased money supply and gold is a hedge against inflation. This means as money supply grows, the price of gold increases, and vice versa. While this rule may not be steadfast, this factor tends to favor gold.

3 Ways to Invest in Gold

In the era of financial technology there are multiple ways to buy, sell, and invest in gold in addition to the traditional route.

1. Physical gold

If you want to have direct exposure to gold, you can invest in physical gold through bullion or coins. This is a great way to manage and protect your gold the way you prefer without a third party. When going this route, it’s important to buy from a reputable source that sells gold with the utmost quality.

Another component to consider with investing in physical gold is safely storing your gold coins and bullion. It’s recommended to store your gold in a safety deposit box or home safe. Preserving the quality and condition of physical gold will maintain its price.

2. Gold stocks

Owning shares of gold mining publicly-traded companies is another popular way to invest in gold long-term. Gold mining companies own mines in different locations around the world, producing and selling gold.

Companies like Newmont, Barrick Gold Corp, Franco-Nevada Corp and others focus on increasing the production and sale of gold and other precious metals to grow their earnings, which can increase the stock price and benefit the shareholders. Stock performance is based on how well these gold businesses are run, and if they perform well on their earnings, their stock value can increase too.

3. Gold ETFs

Another popular way to get exposure to gold is through gold exchange-traded funds. Gold ETFs invest in the physical gold bullion to follow the value of gold. This investment vehicle gives investors the opportunity to enjoy the benefits of investing in gold without owning the physical asset.

This is seen as a more flexible option since you don’t have to worry about storing and maintaining physical gold, rather investors would just buy and hold the gold ETF. Some reputable gold ETFs in crude SPDR Gold Shares (GLD), iShares Gold Trust (IAU) and VanEck Merk Gold Trust (OUNZ).

3 Gold Investing Strategies

1. Strategic Allocation

Allocation is the act of distributing something. In financial terms, it means choosing how much money to put toward each of your investments.

The first step in incorporating gold into your investment portfolio is deciding how much you want to allocate to the precious metal. Keep in mind that gold is mainly a portfolio diversifier that is uncorrelated to conventional assets like stocks and bonds, which helps it manage portfolio volatility.

That said, if you are an aggressive investor seeking portfolio growth, you probably want a lower allocation toward gold. That way gold can help stabilize short-term price swings but it doesn’t interfere with your overall portfolio’s purpose of higher growth.

2. Dollar Cost Average

If you choose to invest in gold through stocks or ETFs, a simple investing strategy is dollar cost averaging. This involves adding to your investment position on a consistent basis with a certain amount of money each time.

For example, you can invest $500 in a gold mining ETF on a monthly basis. The amount you choose to invest depends on how much you can afford. This can easily be done through your brokerage account and if you choose to automate the dollar cost averaging strategy, you don’t have to worry about money transfers, buying and selling the asset.

3. Gold in Your Retirement Account

For those who are taking a self-directed approach to retirement, you can invest gold and other precious metals in an Individual Retirement Account or an IRA. This is also known as a gold IRA, which is a plan that combines your IRA with investing in physical gold.

You have to buy the gold through a custodian who purchases the gold on your behalf and delivers it to an IRS-approved facility like a depository. This is a great option if you’re looking to diversify your portfolio.

Gold can play an important role in any investment portfolio or retirement account.

Takeaway: There Are Several Options for Buying Gold

The value of gold has been maintained for thousands of years. This safe haven asset is one of the most popular investments that is a part of many investors’ portfolios. If you are new to gold investing, it’s important to understand the characteristics of gold and how it can help stabilize investments during times of volatility, economic instability and inflation.

There are a variety of ways to invest in gold, whether it be owning physical bullion or coins, gold mining stocks or gold ETFs, there is flexibility in how to choose exposure to the precious metal that suits your investing needs. Considering some of the challenges our economy is facing today, now may be the ideal time to become a buy and hold gold investor.

Written by Paulina Likos

Read more about investing in precious metals from the expert authors at Gainesville Coins:

Gold vs. Cash: Comparing the Pros and Cons

Best Way to Buy Silver: Guide to Buying Physical Silver

How to Buy Gold Coins: Essential Advice to Get Started

PAMP Suisse Gold Bars Buyer's Guide