Buy Silver Bullion

- Gold

- Silver

- Platinum

- Palladium

- 1 gram

- 2.5 gram

- 5 gram

- 10 gram

- 50 gram

- 100 gram

- 250 gram

- 1/20 oz

- 1/10 oz

- 1/5 oz

- 1/4 oz

- 1/2 oz

- 1 oz

- 2 oz

- 5 oz

- 10 oz

- 20 oz

- 50 oz

- 100 oz

- 1/2 kilo

- 1 kilo

- 5 kilo

- 10 kilo

- Monster Boxes

- Pre 1933 Gold

- Gold

-

Silver

- American Silver Eagles

- Silver Coins

- Silver Rounds

- Silver Bars

- Canadian Silver Maples

- "Junk Silver" 90% Silver Coins

- Silver Dollars

- IRA Eligible Silver

- Gainesville Coins Exclusive

- Austrian Silver Philharmonics

- Chinese Silver Pandas

- South Korean Silver

- European Silver Coins

- Shop Silver By Region

- Shop Silver By Mint

- All Other Items

- New Arrivals

- Best Sellers

How to Buy Silver Bullion Coins and Bars from Gainesville Coins

Gainesville Coins is your trusted source for purchasing precious metals at the lowest prices. Orders can be placed online 24/7 or by calling us Monday - Friday at (813) 482-9300 from 9am until 6pm EST.

We accept many different forms of payment including Visa, MasterCard, Discover, American Express, personal & business checks, money orders, cashier's checks, and bank wires.

All of our shipments are sent discreetly with fully insured shipping until the time of delivery.

Gainesville Coins customers enjoy no minimum orders, no cold calls and no commission sales people.

There is no need to worry about the price of gold and silver moving as your prices are locked in at the time of your order.

With over $10 billion dollars in trusted transactions since 2006, Gainesville Coins is one of the most trusted gold and silver bullion dealers worldwide.

Want to know more about how to purchase silver and what is the best silver to buy? Be sure to check out our comprehensive investors' guide to buying physical silver for more information about how to buy silver online!

We always are running deals for silver at discounted clearance pricing, so be sure to check our Deals page often.

Overall, the process of buying silver is pretty simple. Orders can be placed over the phone, or online. Accepted payment methods include check, credit card, bank wire, and even certain cryptocurrencies. Choosing between shipping methods or vault storage is another important consideration.

Make sure you check out what inventory of silver products are available prior to your purchase. We sell silver rounds and silver bullion bars from many trusted brand names. These are also .999+ pure silver.

Our vast inventory of silver for sale includes:

Silver Rounds For Sale

People usually buy silver rounds when they're interested in what is the cheapest way to buy silver. But silver bullion rounds can be artistic! We also offer a full range of silver art rounds, such as:

- Silver Buffalo Rounds

- Mercury Dime Design Silver Rounds

- Walking Liberty Design Silver Rounds

- Peace Dollar Design Silver Rounds

- Morgan Dollar Design Silver Rounds

- Mason Mint Heritage Silver Rounds, and many more.

The most common sizes are 1 oz and 2 oz silver rounds. Keep in mind that silver rounds are silver bullion, but they have no legal tender status and do not carry face value like coins.

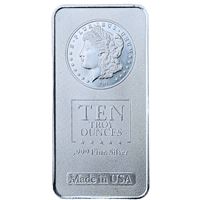

Silver Bars For Sale

When you buy silver bars, you can choose from unique hand-poured silver bars or minted bars. Mint silver bars come from brands such as Johnson Matthey silver bars, PAMP Suisse silver bars, Sunshine Mint silver bars, Mason Mint, Heraeus, and others in a variety of sizes by weight (troy ounces), including:

- 1 Oz Silver Bars

- 5 Oz Silver Bars

- 10 Oz Silver Bars

- 1 Kilo Silver Bars (32.15 Oz.)

- 50 Oz Silver Bars

- 100 Oz Silver Bars

Unlike coins silver bars have no legal tender face value. Because they are priced based on their fine metal content, silver bars are easy to sell down the road. You also have the flexibility to choose from 1 ounce, 10 ounce, 100 ounce, or sometimes even 1000 ounce bars. 1 ounce silver bars made by reputable refiners are the most common choice.

Some .999 fine silver bars come with special designs. These artistic themed silver bars also come in a variety of hand-poured shapes. When you shop for silver bars online, you can always find the right silver bar for you.

Silver Coins For Sale

There are three main categories of silver coins: modern bullion coins, antique numismatic silver coins, and modern collectible silver coins.

Modern Bullion Coins For Sale

We sell silver investment coins, or bullion silver coins, from many nations around the world. The most prominent silver bullion coins are the Silver American Eagle coins and Silver Canadian Maple Leaf coins. Today's modern silver coins are generally made from a .999-fine (or 99.9% pure silver) silver content and come in various designs and face value denominations. We carry both backdate and 2020 silver coins. These coins include:

- American Silver Eagles

- Chinese Silver Pandas

- Canadian Silver Maple Leafs

- Mexican Silver Libertads

- Austrian Silver Philharmonics

- Royal Mint British Silver Britannias

- South African Silver Krugerrands, among many others.

Numismatic Silver Coins For Sale

Legal-tender silver coins are popular because they can make wonderful long-term investments, a handsome collection, or can even be spent as money in emergency situations.

Among the most popular numismatic silver coins are the widely recognized and collected Morgan and Peace silver dollars struck by the United States Mint during the American Renaissance of coins. U.S. Mint silver coins will often be certified silver coins, meaning a third-party grading service has evaluated the coin's collectible condition.

We also sell United States pre-1965 junk 90% silver coins, 40% silver coins, Canadian silver coins, British silver coins, and a wide range of old circulated silver coins from Canada, Australia, Mexico, and other countries.

Modern Collectible Silver Coins For Sale

These unique, limited-mintage coins may sell for higher premiums than their bullion counterparts but they also offer excellent liquidity due to their higher demand and diverse crossover appeal for coin collections. Australia’s Perth Mint is one of the world’s largest producers of these exquisite coins for investors that include the following Australian silver coin series:

- Silver Kookaburra

- Silver Koala

- Silver Lunar New Year Series

- Silver Kangaroo

Shop for Silver by Mint

When you choose Gainesville Coins for buying silver, you can conveniently shop for silver by mint. We offer coins and other silver products from many government mints:

- United States Mint silver

- Royal Canadian Mint silver

- Chinese Central Mint silver

- Perth Mint silver

- Austrian Mint silver

- Mint of Poland silver

- Royal Mint silver (United Kingdom), and many others.

We also carry silver from respected private refiners such as Sunshine Mint and Mason Mint.

For more information about buying silver bullion or to buy silver coins, rounds, and bars, please stop by our luxury showroom or contact us any time at GainesvilleCoins.com today. We are here to help whether you're making an in-person or online silver purchase. If you have any questions, please call us during normal business hours at (813) 482-9300.

We have been serving clients throughout the United States and markets around the globe since 2006. Gainesville Coins has built a solid reputation as a leading silver bullion dealer. Our experts will be happy to help you buy silver or any other products you may be looking for, including gold bullion, third-party-graded rare coins certified by Professional Coin Grading Service (PCGS) or Numismatic Guaranty Corporation (NGC), and many other collectible and investment coins and products. You can rest assured knowing that when you buy from Gainesville Coins, you will receive excellent service and can complete your transaction in a discreet, secure manner.