Why We Are at the Start of a Multi-Year Gold Bull Market

Recently the dollar gold price aggressively broke a multiyear resistance level on the back of escalating wars, worrying asset bubbles, and sticky inflation. Long term indicators show gold is undervalued under these circumstances and can easily double in price over the coming years.

Image source: ONB

The past decades have been characterized by an elevated trust in credit instruments that blew the global financial system to colossal proportions. Now tensions between East and West, debt saturation and inflation are chipping away this trust, the balance between financial instruments with counterparty risk (credit) and without counterparty risk (gold) will go through a process of adjustment in favor of the gold price.

The Theory of Money and Exter’s Inverse Pyramid

“Money is gold, and nothing else.”

J.P. Morgan testimony before Congress 1912 (page 5)

Philosophically speaking all moneys are backed by trust. Because money is a social agreement it can be whatever we think it is—tobacco, salt, paper slips, silver, book entries, and so forth. Money functions as long as it is accepted by market participants.

But not all moneys are equal. Some moneys—for example tobacco and salt—are inconvenient in the modern age. Other moneys are issued by banks and therefor carry counterparty risk. Since the late 19th century gold is “officially” the only form of money that is universally accepted, has no counterparty risk, and therefore underpins the global financial system.

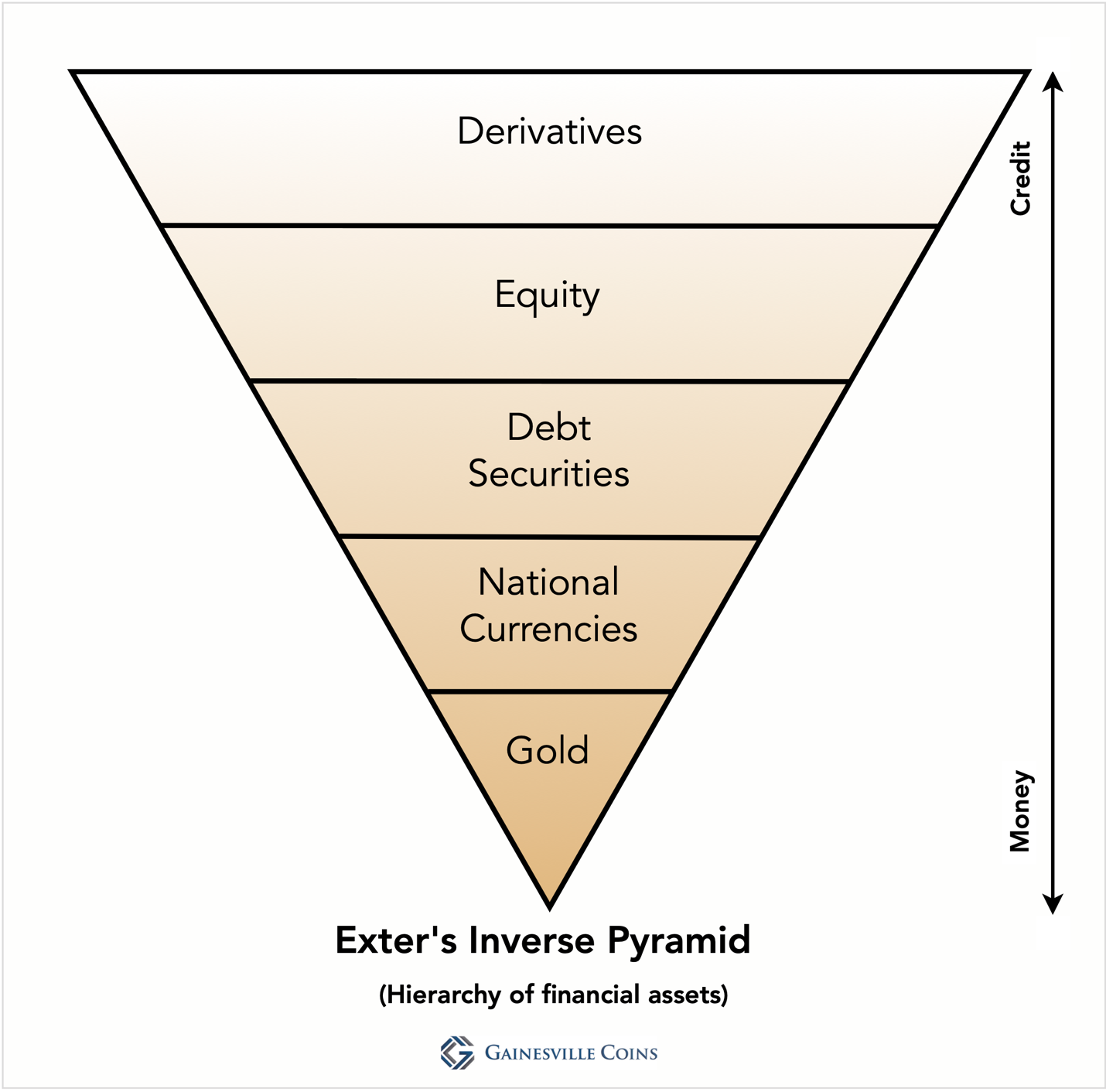

In previous articles we talked about Perry Mehrling’s hierarchy of money, Exter’s inverse pyramid, and the order in which the International Monetary Fund (IMF) lists financial assets. All three have in common that they pose gold as the ultimate money, followed by national currencies, debt securities, equity, and then derivatives. This sequence of financial assets reflects if assets are more money or credit like.

Below is a visualization of Exter’s inverse pyramid, whereby gold sits at the bottom, ultimately “backing” all forms of credit resting on top of it and providing indispensable trust to the financial system.

In moderation, credit is beneficial to a capitalist economy—too much credit (debt) results in lower growth, too little means foregone opportunities. But in general, and especially during a crisis, people have more trust in gold than credit.

Because everything above gold can be created out of thin air, the top of the pyramid can be easily widened. Throughout the business cycle balance sheets are extended—credit is created, the crown of the pyramid is enlarged—causing an economic boom. During a recession balance sheets shrink, the gold price increases, and the shape of the pyramid is remodeled. The overall size of the pyramid grows over time, while the pyramid’s form changes simultaneous with debt cycles.

Ratios between gold and credit assets can tell us where we are in a debt cycle. At the time of writing, we are in a boom as:

- Gold as a share of global financial assets is low.

- The US broad money supply relative to the gold “backing” it is overstretched.

- Gold’s share of central banks’ international reserves is low.

- Equity market valuations are high.

All the while trust in credit is waning, suggesting the gold price will rise (policy makers will avert outright defaults inducing a deflationary collapse).

New Multi-Year Gold Bull Market Has Begun

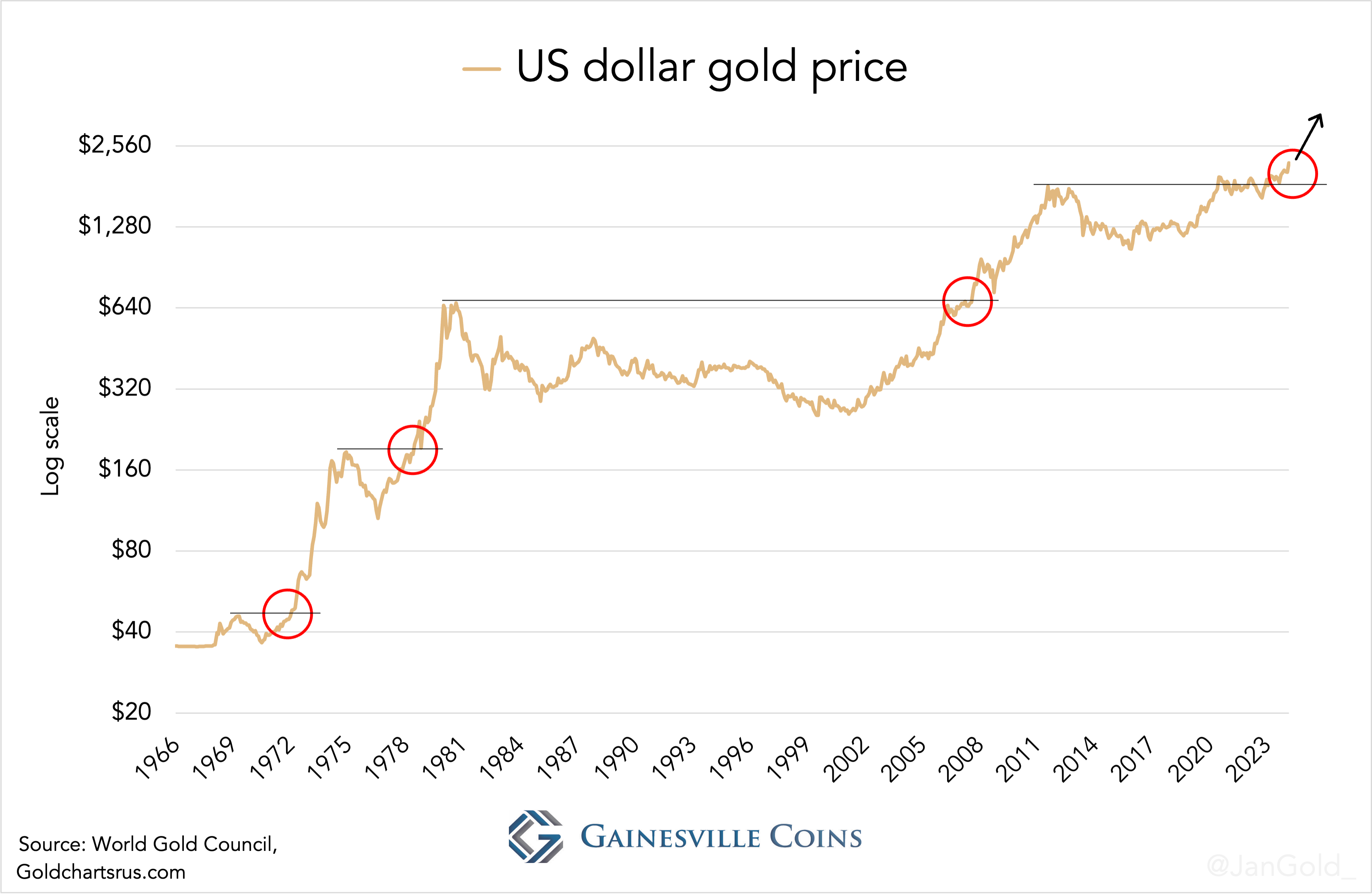

Let us first define what has recently happened to the gold price. From a technical perspective, as you can see in the chart below, the price of gold has broken out from a multi-year consolidation phase. If we may use history as our guide, we are now entering a multi-year bull market.

Chart 1. Gold price in US dollars from the 1960s until March 2024.

Next, we will examine the long-term fundamental indicators that display gold is undervalued under the conditions of declining trust in credit.

Unfortunately, it’s impossible to find global data on all financial assets going back 150 years to compare the value of all credit to that of gold. Though I did find estimates by Bridgewater Associates on the ratio between gold and “financial assets” (in this case gold, debt, and equity) from 1924 until 2020. I was able to roughly mimic Bridgewater’s methodology for the last two decades and could thus extend their data series.

Chart 2. Above ground gold as a percentage of global financial assets (gold, debt, and equity).

As we can see, during periods when trust in credit is poor, in the Second World War and at the end of the 1970s, gold’s value relative to financial assets was in between 7 and 10%. Currently gold is worth 3%, which goes to show there is ample upside for gold this bull run.

Let’s also have a look at the value of the monetary gold supporting the US dollar broad money supply. What currency is more appropriate for assessing this ratio than the world reserve currency?

The value of the US monetary gold ultimately underpinning the dollars in circulation is rising from a near historic low. The two previous lows were in 1971 and 2000, after which multi-year gold bull markets followed. So, most likely a new bull market is upon us.

Making matters worse is that the dollar’s reserve currency status is slowly declining at the moment. My next measurement, therefor, is the relationship between gold and credit in the form of foreign exchange.

On the classical gold standard in the 19th century, it was mainly gold that underpinned confidence in central banks. Most of their reserves consisted of gold that literally backed the monetary base as currency could be redeemed for physical metal at a fixed parity. In the Interbellum it was agreed that foreign exchange (sterling and dollars) could substitute gold on central banks’ balance sheets to allow monetary expansion beyond the growth of the above ground stock of gold. This came to be known as the gold exchange standard. After the Second World War the US pushed the world to save in dollars and gold’s share of global international reserves declined sharply. Especially in the 1980s trust in dollars boomed.

But gold’s share of total reserves is presently on the rise, for one because trust in dollars is eroding due to the freezing of Russian assets worth $300 billion since the war in Ukraine that started in 2022. Second, the United States’ public debt is spiraling out of control while the Federal Reserve can’t get inflation tamed. Central banks are currently buying record amounts of gold and drive up the price.

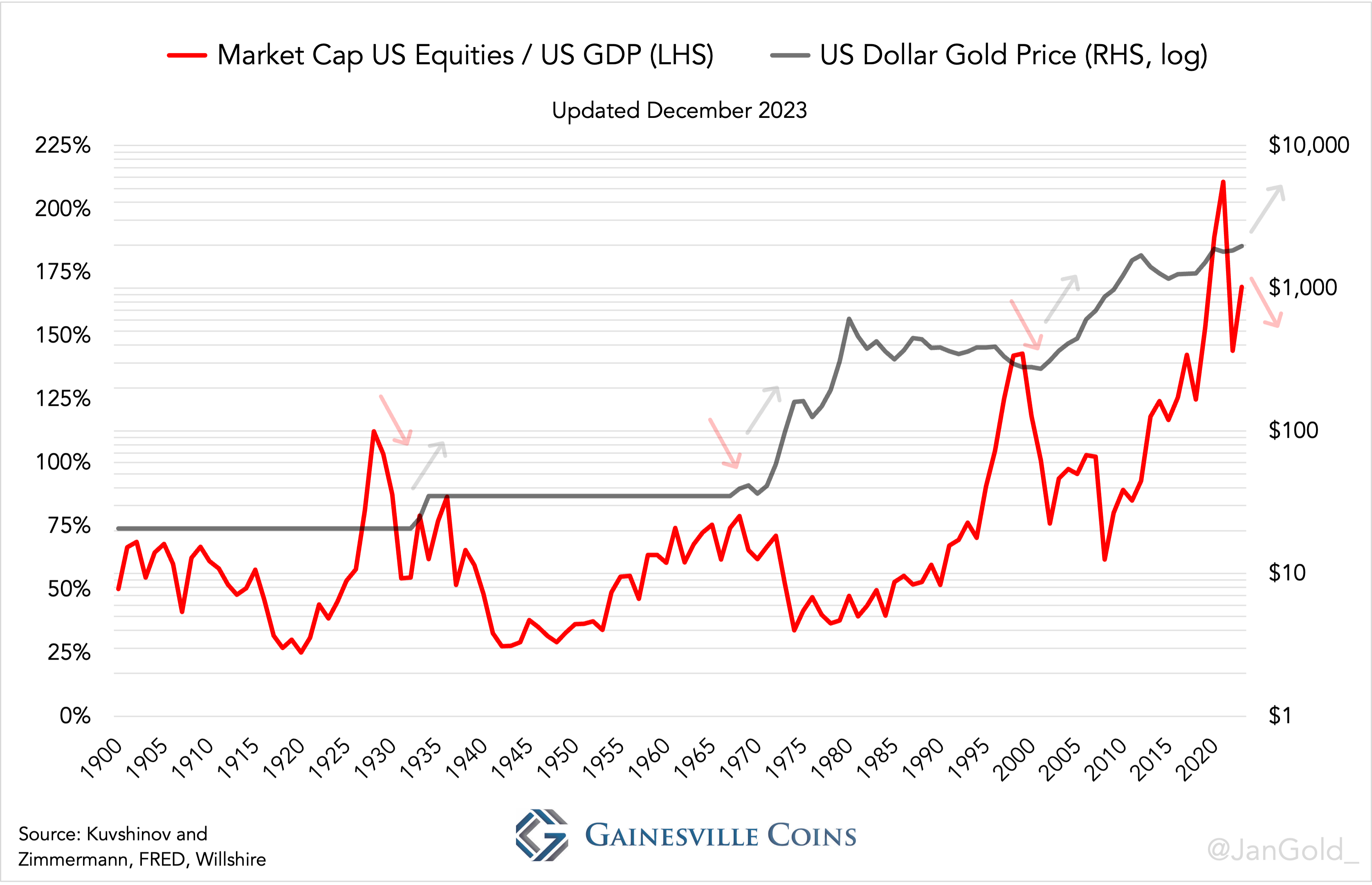

For our final data series, we will look at the size of the US equity market versus the size of the economy (GDP) going back 120 years. Equity can be seen as a form of debt with no maturity. What the data reveals is that over time there have been cycles of easy money (credit) blowing equity bubbles, followed by the debasement of currency, reflected in a higher gold price.

The cycles can be best explained as follows: once a bubble pops, central banks ease monetary policy to stimulate the economy, but they often overshoot and plant the seeds for the next bubble—national currency (fiat) is the air that bubbles are commonly made of. This leads to a vicious cycle of bubbles and ever-easier money in which the value of currency incrementally declines, and the gold price appreciates. Cycles reminiscent of Exter’s pyramid widening (credit expands) and reshaping (gold price goes up). Time and again.

Currently the equity market (relative to GDP) is probably close to its peak, suggesting the gold price will see a significant rise in the coming years.

Conclusion

The West not only froze dollar assets owned by the Russian central bank early 2022 at the start of the war, but Congress just approved a bill to confiscate such assets and give them to Ukraine. What could speed up “de-dollarization” by BRICS members and other countries faster than this? Tensions between East and West will not be resolved quickly, telling us the gold price will continue to march higher and gold’s share of global international reserves will rise to the detriment of the dollar.

It should be noted that the Chinese central bank was a buyer of gold in the 1960s and 1990s before gold made substantial moves to the upside (see chart 1). Timothy Green writes in The World of Gold Today (1973):

In 1965 …., China bought 100 tonnes of gold … in the London market; the following year she came back for another 30 tonnes. Two years later China topped up with another 60 tonnes. The main reason behind these forays into the gold market appears to have been to divest itself of sterling [the second world reserve currency at the time]. Although no official figures of China’s reserve are available, it is likely that she substituted a good part of her holdings of sterling for gold before [the sterling] devaluation in 1967.

Dutch Newspaper NRC Handelsblad reported in 1993 that the People’s Bank of China (PBoC) was one of the buyers of a massive sale by the central bank of the Netherlands. As other European central banks sold heavily during the 1990s as well, we may assume the PBoC bought some more of that and reaped the benefits when the dollar gold price began its ascent around 2000.

As I have reported repeatedly since 2022, the PBoC is presently buying gold hand over fist. Do the Chinese have a sixth sense for sniffing out currency devaluations?

The gold price can be used as an inflation expectations indicator. In the chart below one can see that a turnaround in the price of gold is often followed by surging inflation within two years. To me it would only make sense if this time around it’s no different.

Chart 6. US consumer price inflation versus the gold price.

As global debt levels are near record highs and have become unsustainable, the most expedient, least well-understood, and common way of restructuring debt (credit) is inflation, according to former hedge fund manager Ray Dalio. Indeed, global debt stands at $313 trillion dollars (330% of GDP) and there are few other options to lower the debt burden. Inflation and a higher gold price would deleverage the system and restore the pyramid.

All in all, it sure looks if we are at the tipping point of rebalancing credit assets compared to gold. Signs of stress in the system are real estate sectors collapsing, banks failing, and central banks making losses. Credit booms are inevitably followed by busts.

Not only are central banks buying gold because “it may play a stabilizing role … in times of structural changes in the international financial system,” (central bank of Hungary) investment funds are slowly doing the same. The Bangkokpost wrote last April that “the Thai Government Pension Fund is reducing investments in assets that may be affected by war and increasing investments in gold and oil to mitigate risk.”

In 2023 I speculated the gold price could reach $8,000 dollars an ounce in the decade ahead. Based on all the data I came across in writing this article I still think that is a reasonable number that would stabilize the financial system by adding more trust to it.

,-and-gold-price.png)