1/10 oz Gold Coins: Complete Buying Guide for 2025

1/10 oz Gold Coins: Complete Buying Guide

Master fractional gold investing with expert strategies for entry-level investors navigating record-high gold prices in 2025

By Gainesville Coins • Updated July 24, 2025

Quick Answer: Should You Buy 1/10 oz Gold Coins?

Yes, 1/10 oz gold coins offer the most affordable entry into physical gold investing at $400-450 per coin. American Gold Eagles provide maximum liquidity while Canadian Maple Leafs offer better value with lower premiums. Despite higher percentage premiums (8-15%), these fractional coins enable dollar-cost averaging and portfolio flexibility that full ounce coins cannot match.

Table of Contents

Understanding 1/10 oz Gold Coins and Their Investment Appeal

The 1/10 oz gold coin represents one-tenth of a troy ounce of gold, containing 3.11 grams of pure gold content. These fractional coins have become increasingly popular among new investors who want to buy gold without the substantial upfront cost of full-ounce coins. At current gold spot prices hovering around $3,367 per ounce, a 1/10 oz coin costs approximately $400-450, making it 90% more affordable than a full ounce coin.

🎯 Key Benefits of 1/10 oz Gold Coins:

- Lower Entry Point: Start investing with as little as $400 versus $3,400+ for full ounce

- Enhanced Liquidity: Easier to sell portions without liquidating entire holdings

- Dollar-Cost Averaging: Affordable monthly purchases smooth price volatility

- Gift-Friendly: Perfect size and value for graduations, birthdays, holidays

- Compact Storage: Roughly penny-sized for discrete, secure storage

- Emergency Fund: Ideal denomination for crisis situations

For entry-level investors, 1/10 oz gold coins serve as an educational tool, providing hands-on experience with physical precious metals at a manageable cost. The lower barrier to entry enables regular monthly purchases, facilitating dollar-cost averaging strategies that smooth out price fluctuations over time. This approach has proven particularly effective given gold's 42% year-over-year increase through mid-2025.

American Gold Eagles vs Canadian Maple Leafs Comparison

The 1/10 oz Gold American Eagle and 1/10 oz Canadian Gold Maple Leaf represent the two most popular fractional gold coins globally, each offering distinct advantages for investors.

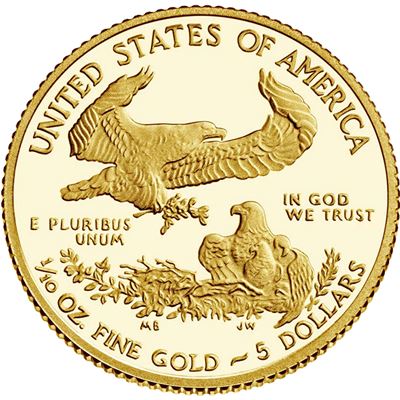

1/10 oz American Gold Eagle

American Gold Eagles feature the iconic Lady Liberty design and contain 91.67% gold alloyed with copper and silver for durability. Despite their 22-karat composition, they contain the full 1/10 oz of pure gold, with the alloy adding to the total weight. These coins command the highest liquidity in North American markets, with over 80% market share among U.S. physical gold buyers.

Key Advantages:

- ✓ Most recognized fractional gold coin globally

- ✓ IRA-eligible for retirement accounts

- ✓ Government backing and guarantee

- ✓ Exceptional resale liquidity

1/10 oz Canadian Gold Maple Leaf

Canadian Gold Maple Leafs boast 99.99% pure gold content, making them the purest regular-issue fractional gold coins available. Advanced security features include micro-engraved maple leaves, radial lines, and Bullion DNA technology that allows instant authentication.

Why Choose Maple Leafs:

- ✓ Highest purity standard (99.99%)

- ✓ Lower premiums than Eagles

- ✓ Advanced anti-counterfeiting features

- ✓ International recognition

The choice between Eagles and Maple Leafs often comes down to personal preference and intended use. Eagles excel in recognition and liquidity within the United States, while Maple Leafs appeal to investors prioritizing purity and international acceptance. Both coins maintain strong resale values and enjoy widespread dealer support globally.

Entry-Level Gold Investing Strategies for Beginners

Starting your gold investment journey requires a strategic approach that balances affordability with long-term wealth building. Financial advisors increasingly recommend 5-15% precious metals allocation in diversified portfolios, up from the traditional 5% ceiling, reflecting gold's role in the modern investment landscape.

Dollar-Cost Averaging Strategy

Dollar-cost averaging emerges as the optimal strategy for accumulating fractional gold. By investing a fixed amount monthly—even as little as $50-100—investors smooth out price volatility while building positions gradually.

- Monthly Budget: $100-500 depending on income

- Purchase Schedule: Same day each month for discipline

- Coin Selection: Alternate between Eagles and Maple Leafs

- Long-term Goal: Accumulate full ounces over time

💡 Pro Tip: Automatic Purchase Programs

Many dealers offer accumulation programs with reduced premiums for committed monthly buyers. Setting up automatic purchases ensures disciplined accumulation without emotional interference.

Mixed Portfolio Approach

For those preferring physical ownership, consider starting with a mixed approach:

Beginner's Gold Portfolio Allocation

This combination optimizes both liquidity and cost-effectiveness while maintaining the benefits of fractional ownership. As your holdings grow, gradually add larger denominations to improve overall premium efficiency.

Fractional Gold Bars as Cost-Effective Alternatives

While 1/10 oz coins offer excellent liquidity and recognition, fractional gold bars present compelling alternatives for cost-conscious investors. These bars, available in metric weights, typically carry lower premiums while providing similar investment benefits.

| Product Type | Weight | Approx. Cost | Premium Range | Gold Content vs 1/10 oz |

|---|---|---|---|---|

| 1g Gold Bar | 1 gram | $70-90 | 8-15% | 32% of 1/10 oz |

| 5g Gold Bar | 5 grams | $350-450 | 6-12% | 160% of 1/10 oz |

| 10g Gold Bar | 10 grams | $700-900 | 4-8% | 321% of 1/10 oz |

🏆 Best Value: 5-Gram Gold Bars

The 5g gold bar strikes an optimal balance, containing 1.6 times the gold of a 1/10 oz coin at competitive 6-12% premiums. These bars cost approximately $350-450, similar to 1/10 oz coins, but deliver 60% more gold content for your investment dollar.

For maximum value, 10-gram bars contain over three times the gold of 1/10 oz coins while commanding just 4-8% premiums. At current prices around $700-900, these bars represent the sweet spot for regular accumulation, offering institutional-quality gold at retail-accessible prices.

Storage Solutions and Security for Small Gold Investments

Proper storage ranks among the most critical yet overlooked aspects of physical gold ownership. Fractional gold's compact size offers advantages but also requires careful organization to prevent loss or misplacement.

🔒 Essential Security Rules:

- ✓ Never publicize gold ownership on social media

- ✓ Avoid discussing holdings with friends or family

- ✓ Use discrete shipping to your address

- ✓ Vary routines when accessing storage

- ✓ Document coins with photos for insurance

- ✓ Keep detailed inventory records separately

- ✓ Consider splitting holdings across locations

- ✓ Review insurance coverage and limits

Building a Balanced Precious Metals Portfolio

Creating an effective precious metals portfolio extends beyond simply choosing between gold and silver. While gold serves as the ultimate store of value, buying silver adds diversification benefits through different price dynamics and industrial demand factors.

Optimal Precious Metals Allocation

Within your gold allocation, balance fractional pieces with larger denominations as your holdings grow:

Progressive Gold Accumulation Strategy

- First 5 ounces: Focus on 1/10 oz coins for maximum flexibility

- 5-10 ounces: Add 1/4 oz coins to improve premium efficiency

- 10-20 ounces: Include 1/2 oz coins and 10-gram bars

- 20+ ounces: Add full ounce coins for core holdings

Maintain 20-30% in fractional sizes even with larger holdings for liquidity needs.

Geographic Diversification

While American Eagles dominate U.S. markets, adding international coins provides additional benefits:

- Canadian Maple Leafs: Lower premiums, higher purity, strong international demand

- Austrian Philharmonics: Europe's top seller, musical instrument design

- British Britannias: No capital gains tax for UK residents, improving design

- Australian Kangaroos: Annual design changes, Perth Mint quality

Market Timing and Current Opportunities in 2025

The gold market in 2025 presents unique opportunities shaped by macroeconomic forces and shifting investor sentiment. With gold establishing new all-time highs above $3,500 and maintaining levels around $3,367, questions about optimal entry timing naturally arise.

🟢 Bullish Factors for Gold

- Central bank purchases at 290 tonnes in Q1 2025

- Currency debasement concerns globally

- Geopolitical tensions increasing

- Mining supply constraints tightening

- Real interest rates remain negative

- Dollar alternatives being developed

🔴 Potential Headwinds

- Technical resistance at record levels

- Cryptocurrency competition

- Potential recession reducing demand

- Strong dollar periods

- Profit-taking after gains

📊 Expert Price Targets

Major financial institutions project continued strength:

- J.P. Morgan: $3,675 by Q4 2025

- Goldman Sachs: $4,000 by mid-2026

- Bank of America: "Sustained levels above $3,000"

These projections rest on expectations of continued Federal Reserve accommodation, persistent inflation pressures, and ongoing geopolitical tensions.

Rather than attempting precise market timing, focus on gold's role as portfolio insurance and long-term wealth preservation. Starting positions now, even at elevated levels, positions investors for potential further gains while providing immediate portfolio protection.

Making Your First 1/10 oz Gold Coin Purchase

Taking the first step into gold ownership requires selecting reputable dealers, understanding pricing dynamics, and executing purchases efficiently.

Research and Compare Dealers

Look for established dealers with:

- Transparent pricing showing premiums over spot

- Clear buy-back policies

- Industry affiliations (PNG, ICTA)

- Strong customer reviews

- Secure shipping options

Calculate Total Costs

When comparing prices, factor in:

- Base coin price (spot + premium)

- Shipping and insurance fees

- Payment method charges (3-4% for credit cards)

- Any applicable taxes in your state

Execute Your Purchase

For your first order, consider:

- Start with 2-4 coins to compare products

- Mix Eagles and Maple Leafs

- Use bank wire for best pricing

- Choose insured shipping

💡 Beginner's First Purchase Recommendation

For your initial purchase, consider this balanced approach:

This variety provides hands-on experience with different products while building initial positions across recognized formats.

Document all purchases carefully, maintaining receipts and photographing items for insurance purposes. The journey into gold investing through 1/10 oz coins offers an accessible path to precious metals ownership that can grow with your financial capabilities.

Ready to Start Building Your Gold Portfolio?

Now that you understand the advantages of 1/10 oz gold coins for entry-level investing, take the next step toward building your precious metals portfolio. Whether you choose the iconic American Gold Eagle or the pure Canadian Maple Leaf, fractional gold provides the perfect starting point for your investment journey.

Questions about fractional gold investing? Our precious metals experts are available to guide you through your first purchase with no pressure or obligations.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Precious metals investments involve risk, and past performance does not guarantee future results. Always conduct thorough research and consult with qualified financial professionals before making investment decisions.