Buy Gold Bars

- Gold

- Silver

- Platinum

- Palladium

- 1 gram

- 2.5 gram

- 5 gram

- 10 gram

- 50 gram

- 100 gram

- 250 gram

- 1/20 oz

- 1/10 oz

- 1/5 oz

- 1/4 oz

- 1/2 oz

- 1 oz

- 2 oz

- 5 oz

- 10 oz

- 20 oz

- 50 oz

- 100 oz

- 1/2 kilo

- 1 kilo

- 5 kilo

- 10 kilo

- Gold

- Gold Coins

- Gold Bars

- American Gold Eagles

- Canadian Gold Maples

- Pre 1933 Gold

- South African Gold Krugerrands

- Low Premium Gold

- American Gold Buffalo Coins

- Mexican Gold Pesos

- Austrian Gold Philharmonic

- 2019 Gold Bullion Coins

- Australian Gold Coins

- European Gold Coins

- Oceania Gold Coins

- IRA Eligible Gold

- Shop Gold By Mint

Buy Gold Bars Online

Gainesville Coins is your trusted source for purchasing gold bars at the lowest prices. Orders can be placed online 24/7 or by calling us Monday - Friday at (813) 482-9300 from 9am until 6pm EST.

We accept many different forms of payment including Visa, MasterCard, Discover, American Express, personal & business checks, money orders, cashier's checks, and bank wires.

All of our shipments are sent discreetly with fully insured shipping until the time of delivery.

Gainesville Coins customers enjoy no minimum orders, no cold calls and no commission sales people.

There is no need to worry about the price of gold and silver moving as your prices are locked in at the time of your order.

With over $10 billion dollars in trusted transactions since 2006, Gainesville Coins is one of the most trusted gold and silver bullion dealers worldwide.

Be sure to read our definitive gold buyer's guide for more information on the best ways to buy gold!

Gold Bars For Sale

There are a number of options for how to buy gold bars, depending on the financial goals and budget of the buyer. You can choose the convenience of an online dealer or search for a local gold bar seller near you. When you buy gold bullion bars locally, you are generally getting the best price available in the gold market.

The process is also rather easy. You can choose from name brand gold bars like those mentioned above, or opt for slightly cheaper generic gold bars.

Many investors will choose to place their gold bars in storage in a secure vault. This is the safest option for storing gold, but it will cost you a small fee. Aside from vault storage, most sellers will also offer shipping methods to your location.

Your best choice for any gold investment is to find an experienced and reputable gold dealer in your local area. At Gainesville Coins, we buy and sell gold on a constant basis. We typically have the lowest price whether you pay by bank wire, check, credit card, or even cryptocurrency.

What Are Gold Bars?

Gold bars come in a variety of weights and sizes. They serve functions as a personal asset, an official reserve currency, and a commercial financial tool. Unlike gold coins such as American Gold Eagles, bars are not legal tender.

Typically, when investors think of gold bars, images of the truncated pyramid shaped bars (popularized by Hollywood) come to mind. They are sometimes called gold ingots and are manufactured as cast gold bars or minted bars.

However, because of the long and versatile list of roles held by gold, bars made from the yellow metal come in a wide range of shapes and sizes. They range from rectangular 1 gram gold bars (like the Valcambi CombiBar) to 400 oz “Good Delivery” bars in the shape of an elongated truncated pyramid. The latter are used by the London Bullion Market Association (LBMA). 1 troy oz gold bars are perhaps the most popular gold bar size.

While you may also see 5 oz and 10 oz sizes, the troy ounce is a less common measurement outside of the United States and Britain. Elsewhere you can find bars of 50 grams and 100 gram sizes, both of which are larger than 1 ounce. Smaller bars even go down to 10 grams, 5 gram, 1 gram, or possibly 1/2 gram sizes. On the high end, there are also 1 kilo gold bars that weigh 1 kilogram. (1 kilo is equal to 32.15 oz.)

Regardless of what size gold bar you choose, nearly all gold bullion bars are .9999 fine gold. Being .9999 pure gold means they are 99.99% pure. This exceeds the requirement for being IRA approved gold bullion products, so you can use them for your precious metals IRA (Gold IRA).

Gold Bar Prices Follow Gold Spot Prices

All gold bars are priced fairly close to the current spot price of gold, whether you are buying or selling. This means they have low premiums compared to gold bullion coins. Low pricing makes bars an especially attractive option for gold investors and investment portfolio managers.

Still, the price of a gold bar varies depending on the brand or manufacturer. (The same is true for silver bars, by the way.) These may be from private mints or government mints. Some popular brands include:

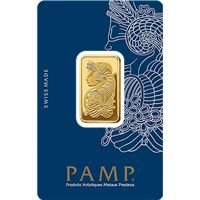

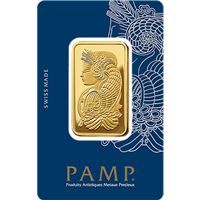

- PAMP Suisse gold bars

- Credit Suisse gold bars

- Royal Canadian Mint gold bars

- Perth Mint gold bars

- Sunshine Mint gold bars

- Johnson Matthey gold bars

- Royal Mint gold bars

In many cases, each of these bars will have their own unique serial number. An assay card is often included as a certificate of authenticity.

Follow the link to learn more about gold bars. You can also check out the Gainesville Coins website for live pricing on silver coins, silver rounds, platinum coins, and other precious metal products.