How to Buy Silver in 2025: Complete Beginner's Guide

How to Buy Silver: Complete Investment Guide for 2025

Master silver investing with expert strategies for building wealth through physical bullion, ETFs, and mining stocks in today's explosive market

By Gainesville Coins • Updated January 21, 2025

Quick Answer: How to Buy Silver

To buy silver successfully: Choose reputable dealers with transparent pricing, start with recognized bullion coins like American Silver Eagles or bars for lower premiums, verify current silver spot prices, compare dealer premiums, and store securely. With silver reaching 13-year highs above $36/oz in 2025 amid historic supply deficits, understanding all investment options—physical, ETFs, and mining stocks—is crucial for maximizing returns.

Table of Contents

- Why Silver Shines in 2025's Market

- 5 Ways to Invest in Silver (Compared)

- Physical Silver: Coins, Bars, and Rounds

- Silver ETFs and Paper Investments

- Step-by-Step Silver Buying Guide

- Dealer Selection and Red Flags

- Complete Storage and Security Guide

- Silver IRA Investment Strategies

- Verifying Authentic Silver

- Portfolio Strategies for 2025

- Market Analysis and Price Targets

- Frequently Asked Questions

Why Silver Shines in 2025's Explosive Market

Silver has emerged as 2025's standout precious metal, surging to $36+ per ounce—levels not seen since 2013. This dramatic rally reflects a perfect storm of factors: industrial demand reaching record 680.5 million ounces, the fifth consecutive year of supply deficits, and explosive growth in solar panel manufacturing consuming 16% of global production.

🎯 Key Drivers Making Silver Essential in 2025:

- Green Energy Revolution: Solar panels now consume 232 million oz annually, doubled since 2015

- Supply Crisis: Fifth straight deficit year with 149 million oz shortfall

- Industrial Explosion: EVs require 25-50g each, 5G infrastructure expanding rapidly

- Investment Surge: Physical demand up 11% year-over-year per Silver Institute data

- Gold Ratio Opportunity: At 92:1 versus 60:1 historical average

- Inflation Hedge: Outperforming gold 3:1 in current rally

Unlike gold's primarily monetary role, silver straddles both industrial necessity and investment demand. The metal's unmatched electrical conductivity makes it irreplaceable in everything from solar panels to electric vehicles, while its historical role as "poor man's gold" attracts investors seeking affordable precious metals exposure. This dual demand creates unique opportunities—and risks—that savvy investors can exploit.

Before diving into investment strategies, check the current silver spot price to understand today's market conditions. With analysts from major institutions projecting $40-50 targets by late 2025, understanding how to buy silver efficiently has never been more critical.

5 Ways to Invest in Silver: Complete Comparison Guide

Unlike gold's straightforward bullion market, silver offers diverse investment vehicles each with distinct advantages. Understanding these options helps you choose the right approach for your goals, risk tolerance, and investment timeline.

| Investment Type | Minimum Investment | Liquidity | Storage Required | Premium/Fees | Best For |

|---|---|---|---|---|---|

| Physical Silver | ~$30 (1 oz round) | High (local/online) | Yes | 5-20% premium | Long-term holders |

| Silver ETFs | ~$25 (1 share SLV) | Instant | No | 0.50% annual | Traders |

| Mining Stocks | Varies | Instant | No | Brokerage fees | Risk seekers |

| Silver Futures | $6,000+ margin | High | No | Commission only | Professionals |

| Silver Mutual Funds | $1,000+ typical | Daily | No | 1-2% annual | Diversifiers |

Physical Silver: The Foundation

Physical ownership remains the purest form of silver investment, eliminating counterparty risk while providing tangible wealth you can hold. However, it requires secure storage and carries dealer premiums. We'll explore physical options in detail in the next section.

Silver ETFs: Paper Convenience

Exchange-traded funds like iShares Silver Trust (SLV) and Sprott Physical Silver Trust (PSLV) offer instant liquidity and fractional ownership without storage concerns. SLV trades over 20 million shares daily, while PSLV offers potential tax advantages as a Canadian trust. However, you're trusting third-party custody and paying annual fees.

Mining Stocks: Leveraged Exposure

Silver miners like First Majestic (AG), Pan American Silver (PAAS), and Wheaton Precious Metals (WPM) provide leveraged exposure to silver prices. A 10% rise in silver often translates to 20-30% gains in quality miners. However, you're also exposed to operational risks, management decisions, and general equity market volatility.

Futures and Options: Professional Tools

CME Group's COMEX silver futures control 5,000 ounces per contract, offering massive leverage but requiring substantial capital and expertise. Micro silver futures at 1,000 ounces provide more accessible entry points for experienced traders.

Physical Silver Deep Dive: Coins, Bars, and Rounds

For investors prioritizing direct ownership and elimination of counterparty risk, physical silver offers unmatched security. Let's explore each category to help you make informed decisions.

Government-Minted Silver Coins

Sovereign coins command premium prices but offer superior liquidity, recognition, and potential numismatic appreciation. These legal tender coins are backed by their issuing governments.

American Silver Eagle

The American Silver Eagle reigns as the world's most popular silver bullion coin. The U.S. Mint's flagship program offers unmatched liquidity and IRA eligibility, though premiums run higher than alternatives. The iconic Walking Liberty design and government guarantee make Eagles ideal for beginners.

Key Investment Benefits:

- ✓ Most liquid silver coin globally

- ✓ IRA-eligible for retirement accounts

- ✓ No reporting on sales (any quantity)

- ✓ Recognized in every market worldwide

Canadian Silver Maple Leaf

The Canadian Silver Maple Leaf offers superior purity at lower premiums than Eagles. The Royal Canadian Mint's advanced security features, including radial lines and micro-engraved privy marks, make these virtually counterfeit-proof while maintaining excellent liquidity.

Why Choose Maple Leafs:

- ✓ Higher purity standard (99.99%)

- ✓ Advanced anti-counterfeiting technology

- ✓ Lower premiums than Eagles

- ✓ Beautiful proof-like finish

Silver Bars: Maximum Efficiency

For investors prioritizing ounces over aesthetics, silver bars deliver the best value with minimal premiums.

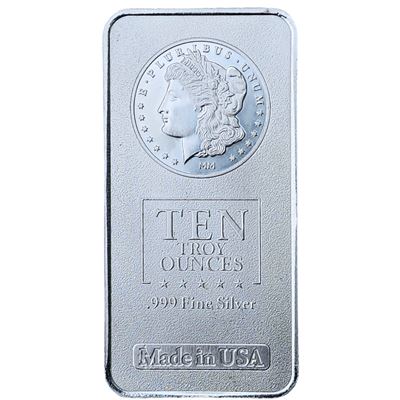

10 oz Silver Bars

The 10 oz silver bar represents the sweet spot for serious stackers. Large enough to minimize premiums but small enough to remain liquid, these bars offer exceptional value. The Morgan design adds aesthetic appeal without numismatic premiums.

Bar Investment Advantages:

- ✓ Lowest premiums per ounce

- ✓ Efficient storage (stackable)

- ✓ Easy to verify and authenticate

- ✓ Ideal for larger investments

Generic Silver Rounds: Budget-Friendly Option

Silver Buffalo Rounds

Private mint silver rounds offer the lowest premiums while maintaining the convenient 1-ounce size. Though lacking government backing, reputable mints produce quality rounds that trade readily in the bullion market. Perfect for investors focused purely on silver content.

Round Advantages:

- ✓ Lowest 1 oz premiums available

- ✓ Same silver content as coins

- ✓ Wide variety of designs

- ✓ No collectible pressure

Junk Silver: Fractional and Recognizable

Pre-1965 U.S. dimes, quarters, and half-dollars contain 90% silver and trade based on their metal content. Currently at 20-22x face value, these circulated coins offer fractional silver ownership and remain widely recognized. A $1,000 face value bag contains approximately 715 ounces of pure silver.

💡 Pro Tip: Diversification Strategy

Experienced stackers often follow a 40/40/20 rule: 40% government coins for liquidity, 40% bars for efficiency, and 20% junk silver for fractional needs. This balances premiums, liquidity, and utility while building a robust physical position.

Silver ETFs and Paper Investments: Digital Alternatives

For investors seeking silver exposure without physical storage challenges, exchange-traded funds provide convenient alternatives. However, understanding the differences between ETF structures is crucial for informed decisions.

Major Silver ETFs Compared

| ETF Name | Ticker | Assets (Billions) | Expense Ratio | Physical Backing | Key Features |

|---|---|---|---|---|---|

| iShares Silver Trust | SLV | $13.2B | 0.50% | London vaults | Most liquid, options available |

| Sprott Physical Silver | PSLV | $5.8B | 0.68% | Canadian Mint | Redeemable for physical |

| Aberdeen Physical Silver | SIVR | $1.9B | 0.30% | London vaults | Lowest fees |

| Invesco DB Silver | DBS | $0.4B | 0.77% | Futures-based | Tax as futures |

SLV vs PSLV: The Key Decision

The two dominant silver ETFs serve different investor needs:

iShares Silver Trust (SLV)

- Trades 20+ million shares daily

- Tightest bid-ask spreads

- Robust options market

- Cannot redeem for physical

- Standard trust structure

Sprott Physical Silver (PSLV)

- Redeemable for 10,000 oz minimum

- Potential tax advantages (PFIC)

- Monthly bar list published

- Royal Canadian Mint storage

- Often trades at premium/discount

Understanding ETF Risks

⚠️ Critical ETF Considerations:

- Counterparty Risk: You own shares, not silver—trustee bankruptcy could impact holdings

- Tracking Error: ETFs may not perfectly match silver prices due to fees and operations

- Authorized Participant Risk: Market makers could fail during extreme volatility

- No Small Redemptions: Individual investors cannot take physical delivery

- Tax Reporting: 1099s generated for all gains, unlike private physical sales

ETFs excel for short-term trading and IRA accounts where physical storage is impractical. However, for long-term wealth preservation, many investors prefer the security of physical ownership combined with ETF trading positions.

Step-by-Step Guide: Your First Silver Purchase

Follow this comprehensive process to ensure a successful first silver investment while avoiding common pitfalls.

Define Your Investment Goals

Before buying, establish clear objectives that will guide every subsequent decision:

- Wealth Preservation: Focus on low-premium government coins and bars

- Speculation: Consider ETFs or mining stocks for leverage

- Crisis Hedge: Prioritize recognizable coins and junk silver

- Industrial Play: Larger bars offer pure exposure to demand

Most successful investors allocate 5-20% of portfolios to precious metals, with silver typically comprising 60-70% of the metals allocation due to higher growth potential.

Research Current Market Conditions

Always check the live silver spot price before shopping. Monitor these key metrics:

- Spot Price: Base value of silver per ounce

- Premium Levels: Current dealer markups (normal: 8-15%)

- Gold/Silver Ratio: Above 80 suggests silver undervalued

- Technical Levels: Support and resistance prices

- Dollar Strength: Inverse relationship with metals

Choose Your Product Type

Match products to your goals and budget:

Select and Verify Your Dealer

Choose established dealers with these credentials:

- Transparent pricing showing spot + premium

- Published buy-back prices (should be 95%+ of spot)

- Physical address and phone support

- Secure website (SSL certificate)

- Clear shipping and insurance policies

- Industry affiliations where applicable

Compare at least three dealers before purchasing. Beware of deals significantly below market—if it seems too good to be true, it probably is.

Compare Total Costs

Calculate the complete investment including:

- Product Premium: Markup over spot price

- Shipping Costs: Often free over certain thresholds

- Insurance: Usually included but verify coverage

- Payment Fees: Credit cards add 3-4%, bank wires often free

- State Sales Tax: Varies by location and purchase amount

Example: 10 oz purchase at $36/oz spot = $360 base + $20 premium + $0 shipping + $0 tax (most states) = $380 total ($38/oz)

Place Your Order

When ready to purchase:

- Lock prices during market hours (9:30 AM - 4:00 PM EST)

- Understand pricing mechanisms (spot + fixed vs. percentage)

- Save all order confirmations and receipts

- Choose payment method wisely (wire/check for savings)

- Verify shipping address accuracy

Receive and Authenticate

Upon delivery:

- Inspect package before signing (photograph any damage)

- Verify correct products and quantities

- Test authenticity (weight, dimensions, magnet test)

- Document serial numbers if applicable

- Secure immediately in predetermined storage

Ready to start building your silver position? Browse our selection of silver bullion products to find the perfect match for your investment goals.

Choosing Reputable Silver Dealers: Protection Against Fraud

The silver market attracts both legitimate businesses and questionable operators. Knowing how to identify trustworthy dealers protects your investment and ensures fair pricing.

Green Flags: Signs of Reputable Dealers

Transparent Operations

- Live pricing tied to spot

- Clear premium structure

- Published buy-back rates

- Physical location listed

- Responsive customer service

Established Presence

- 5+ years in business minimum

- Verifiable company history

- Professional website/communications

- Educational content provided

- Market analysis offered

Customer Protection

- Secure payment processing

- Insured shipping standard

- Return/exchange policies

- Privacy protection

- Complaint resolution process

Red Flags: Warning Signs to Avoid

⚠️ Run From Dealers Who:

- Use High-Pressure Tactics: "Limited time" offers, "exclusive deals," must buy today

- Push Numismatic/Collectible Coins: Excessive focus on rare coins with huge premiums

- Lack Transparency: Won't provide clear pricing or total costs upfront

- Make Unrealistic Claims: Guaranteed profits, insider information, "can't lose"

- Require Large Minimums: Forcing $10,000+ first purchases

- Hide Behind P.O. Boxes: No physical address or phone number

- Charge Excessive Premiums: 30%+ markups on common bullion

- Won't Buy Back Products: Legitimate dealers always offer two-way markets

Online vs. Local Dealers: Strategic Comparison

| Factor | Online Dealers | Local Coin Shops | Best Use Case |

|---|---|---|---|

| Pricing | Lower premiums (volume) | Higher but negotiable | Online for bulk buying |

| Selection | Comprehensive inventory | Limited current stock | Online for specific items |

| Privacy | Digital paper trail | Cash transactions possible | Local for anonymity |

| Verification | Trust required | Inspect before buying | Local for authentication |

| Convenience | 24/7 ordering | Limited hours | Online for flexibility |

Complete Storage and Security Guide for Silver Holdings

Unlike gold's compact value, silver's lower price-to-weight ratio creates unique storage challenges. A $50,000 investment equals roughly 25 ounces of gold but 1,400 ounces of silver—requiring 56 times more space. Planning proper storage before purchasing prevents costly mistakes.

Storage Options Analyzed

Insurance Considerations

Standard homeowners policies typically limit precious metals coverage to $1,000-2,500. For substantial holdings, consider:

- Scheduled Personal Property Riders: Add specific coverage for declared metals (requires appraisals)

- Valuable Articles Policies: Separate policies for high-value collections

- Private Vault Insurance: Often included with professional storage

- Self-Insurance: Many investors accept risk rather than declaring holdings

Security Best Practices

🔒 Essential Security Protocol:

- ✓ Tell NO ONE about your silver holdings—not family, friends, or social media

- ✓ Use generic return addresses when ordering online

- ✓ Vary your routines when accessing storage locations

- ✓ Install security systems but don't mention protecting silver

- ✓ Keep detailed inventory records stored separately from metals

- ✓ Consider decoy safes with small amounts while hiding bulk elsewhere

- ✓ Document with photos for insurance but store images securely

- ✓ Plan for estate transfer (trusted person knows location)

💡 Advanced Strategy: Diversified Storage

Professional investors often use the "rule of thirds": 1/3 immediately accessible (home), 1/3 secure but accessible (bank box), and 1/3 maximum security (private vault). This balances liquidity, security, and risk while ensuring you're never completely locked out of your wealth.

Silver IRA Investment Guide: Tax-Advantaged Strategies

Individual Retirement Accounts accepting physical silver offer unique advantages for long-term investors. Understanding IRS rules and approved products helps maximize tax benefits while building retirement wealth.

IRA-Eligible Silver Products

The IRS requires minimum .999 fineness for silver in IRAs, with specific approved products:

✅ IRS-Approved Silver:

- American Silver Eagles - Any year (exception to .999 rule)

- Canadian Silver Maple Leafs - .9999 fineness

- Austrian Silver Philharmonics - .999 fineness

- Australian Silver Kangaroos - .9999 fineness

- Silver bars and rounds - From approved refiners (COMEX, LBMA good delivery)

❌ Not Allowed:

- Pre-1965 junk silver (90% purity)

- Collectible or numismatic coins

- Silver jewelry or silverware

- Foreign coins below .999 fineness

Silver IRA Setup Process

Choose Self-Directed IRA Custodian

Select an IRS-approved custodian specializing in precious metals. Compare fee structures including setup, annual maintenance, storage, and transaction costs. Typical annual fees range from $100-300 plus storage.

Fund Your Account

Options include: Direct rollover from existing IRA/401(k), 60-day indirect rollover, annual contributions ($7,000 for 2025, $8,000 if 50+), or transfer from existing precious metals IRA.

Select Approved Dealer

Work with IRA-approved dealers who ship directly to depository. Never take personal possession of IRA metals—this triggers taxable distribution plus 10% penalty if under 59½.

Choose Depository Storage

IRS requires approved third-party depositories.

Tax Advantages and Considerations

| Account Type | Tax Treatment | Contribution Limits | Best For |

|---|---|---|---|

| Traditional IRA | Tax-deferred growth, deductible contributions | $7,000 ($8,000 if 50+) | High earners seeking deductions |

| Roth IRA | Tax-free growth and withdrawals | $7,000 (income limits apply) | Young investors, tax diversification |

| SEP-IRA | Tax-deferred, high contribution limits | 25% of income or $70,000 | Self-employed, business owners |

| Solo 401(k) | Tax-deferred, highest limits | $70,000 + catch-up | High-earning self-employed |

Costs vs. Benefits Analysis

Silver IRAs carry additional costs compared to regular IRAs:

- Setup Fees: $50-150 one-time

- Annual Custodian: $75-300

- Storage Fees: $100-300 per year

- Transaction Fees: $40-50 per trade

- Insurance: Often included in storage

These costs make sense for larger accounts ($25,000+) where tax benefits outweigh fees. Smaller investors might prefer ETFs in regular IRAs until building sufficient capital.

⚠️ Critical IRA Rules:

- No personal possession of IRA metals (prohibited transaction)

- No commingling personal and IRA metals

- Required minimum distributions apply at 73

- Early withdrawal penalties before 59½

- Cannot use IRA metals as loan collateral

Verifying Authentic Silver: Protection Against Counterfeits

As silver prices rise, counterfeit products proliferate. While government mints employ sophisticated anti-counterfeiting measures, knowing basic authentication techniques protects your investment.

Basic Authentication Tests

Weight Test

Silver's specific gravity (10.49) makes weight verification crucial. A genuine 1 oz silver coin should weigh exactly 31.1035 grams (±0.1g). Use a scale accurate to 0.1 grams minimum.

Dimension Check

Measure diameter and thickness with calipers. Silver Eagles: 40.6mm diameter, 2.98mm thick. Even sophisticated fakes struggle to match both weight AND dimensions perfectly.

Magnet Test

Silver exhibits weak diamagnetic properties. Strong magnets slightly repel genuine silver, while it slides slowly down angled magnets. Magnetic attraction indicates base metal fakes.

Sound Test

Silver produces a distinctive high-pitched ring when struck. Compare suspect coins to known genuine pieces. Base metals create dull thuds instead of clear ringing.

Visual Inspection

Examine details under magnification. Look for: consistent reeding, sharp strike details, proper luster, correct fonts, and security features (Maple Leaf micro-engraving).

Ice Test

Silver's thermal conductivity melts ice rapidly. Place ice cubes on silver vs. other metals—silver melts noticeably faster. Simple but effective for bars.

Advanced Testing Methods

| Test Method | Cost | Accuracy | Pros | Cons |

|---|---|---|---|---|

| Electronic Tester | $200-500 | 95%+ | Non-destructive, quick | Surface only |

| Ultrasonic Gauge | $300-1,000 | 99%+ | Tests thickness throughout | Learning curve |

| XRF Analyzer | $15,000+ | 99.9% | Exact composition | Professional only |

| Specific Gravity | $50 | 98% | Precise density test | Time consuming |

Common Counterfeits to Avoid

⚠️ High-Risk Fake Categories:

- Chinese Silver Pandas: Most counterfeited coin—buy only from authorized dealers

- Morgan Silver Dollars: Key dates often fake—authenticate before paying premiums

- 100 oz bars: Tungsten-filled fakes exist—ultrasonic testing recommended

- eBay/Craigslist deals: Fake central—avoid peer-to-peer unless expert

- Suspiciously cheap silver: If priced below spot, it's definitely fake

Dealer Authentication

Reputable dealers test all incoming products, but verify their procedures:

- Ask about testing methods used

- Confirm money-back authenticity guarantee

- Request test results for large purchases

- Verify dealer buyback policies (fakes rejected)

💡 Smart Authentication Strategy

Buy one genuine example of each product type you stack from authorized dealers. Keep these as reference pieces for comparison testing. The $100-200 "education cost" prevents thousands in potential losses from fakes.

Silver Portfolio Strategies for Maximum Returns

Successful silver investing requires more than just buying and holding. Understanding different strategies helps optimize returns while managing risk in this volatile market.

Core Investment Approaches

1. Physical Accumulation (Stacking)

The foundation strategy for most silver investors focuses on steadily acquiring physical ounces regardless of price.

- Allocation: 60-80% of silver holdings

- Products: Mix of coins, bars, and rounds

- Timeline: 5+ year minimum hold

- Goal: Wealth preservation and crisis hedge

Dollar-cost averaging monthly purchases smooths volatility. Many stackers target 100-500 ounces as initial goals, representing $3,600-18,000 at current prices.

2. Trading the Gold/Silver Ratio

This advanced strategy exploits the historical relationship between gold and silver prices to increase total ounces without adding capital.

- Current Ratio: ~92:1 (92 oz silver = 1 oz gold)

- Historical Average: 60:1

- Strategy: Trade gold for silver above 80:1

- Reverse: Trade silver for gold below 50:1

Example: Trading 1 oz gold for 92 oz silver today, then reversing at 50:1 nets 1.84 oz gold—84% gain in ounces.

3. Premium Arbitrage

Exploit premium variations during volatile markets by trading between product types.

- High Demand: Sell Eagles/Maples, buy generic

- Low Demand: Sell generic, buy government coins

- Opportunity: 2020 saw Eagle premiums hit 40%+

- Current: Premiums normalizing, less opportunity

4. Leveraged Paper Trading

Use ETFs and mining stocks for short-term trades while maintaining physical core holdings.

- Allocation: 20-40% of silver exposure

- Vehicles: SLV options, junior miners, SILJ ETF

- Risk Level: High—can lose entire investment

- Reward: 3-5x leverage to silver price moves

Portfolio Construction Models

Conservative Silver Portfolio

Balanced Silver Portfolio

Aggressive Growth Portfolio

Strategic Timing Considerations

While impossible to perfectly time markets, certain patterns offer guidance:

Historical Silver Seasonality:

- January-February: Often strong from new year positioning

- March-May: Typically weakest quarter

- June-August: Summer doldrums create buying opportunities

- September-December: Strongest period from Indian festival demand

Combine seasonal patterns with technical analysis and fundamental drivers for optimal entry points. However, for long-term investors, time in market beats timing the market.

Ready to implement your strategy? Start with our selection of investment-grade silver products or explore gold bullion options for ratio trading opportunities.

Silver Market Analysis: 2025 Outlook and Price Targets

Understanding current market dynamics helps position portfolios for potential opportunities while managing downside risks.

Fundamental Drivers in 2025

🟢 Bullish Catalysts

- Supply Deficit: Fifth consecutive year per Silver Institute

- Solar Explosion: 32% growth projected for 2025

- EV Adoption: Each vehicle needs 25-50 grams

- Investment Demand: 11% increase year-over-year

- Mining Constraints: Few new primary silver mines

- Industrial Innovation: 5G, AI data centers expanding

- Monetary Metals: Central banks diversifying reserves

🔴 Bearish Risks

- Recession Fears: Could reduce industrial demand

- Dollar Strength: Inverse correlation with metals

- Profit Taking: After 30%+ gains, natural pullbacks

- Interest Rates: Higher yields compete with metals

- Technical Resistance: $38-40 major hurdle

Price Projections from Major Analysts

| Source | 2025 Target | Bull Case | Base Case | Bear Case |

|---|---|---|---|---|

| Bank of America | $38-42 | $50 | $40 | $32 |

| CPM Group | $35-45 | $48 | $38 | $30 |

| Metals Focus | $40-50 | $55 | $45 | $35 |

| Silver Institute | Deficit continues | 200M oz deficit | 150M oz deficit | 100M oz deficit |

Technical Analysis Levels

Support Levels

- Strong: $32.50 (2024 breakout)

- Major: $30.00 (psychological)

- Critical: $26.50 (200-week MA)

Resistance Targets

- Near-term: $38.50

- Intermediate: $42.00

- Major: $50.00 (2011 high)

Key Indicators

- RSI: 68 (approaching overbought)

- 50-day MA: $34.80

- 200-day MA: $31.20

Actionable Investment Timeline

📊 Strategic Entry Points for 2025

Immediate (Q1 2025): Dollar-cost average positions, focus on low-premium products during consolidation phases

Spring (Q2 2025): Watch for seasonal weakness to accumulate, particularly May-June period

Summer (Q3 2025): Traditional buying season, increase positions if prices remain under $40

Fall (Q4 2025): Monitor gold/silver ratio for potential trading opportunities as festival demand peaks

Track live market movements with our real-time silver price charts and compare with gold price trends for ratio opportunities.

Frequently Asked Questions About Buying Silver

You can start with as little as $30-40 for a single 1-ounce generic silver round. Popular starting points include: 5-10 ounce starter pack ($180-360), roll of 90% silver dimes ($150+), or a single American Silver Eagle ($40-45). Many investors begin with $500-1,000 to diversify across different product types while minimizing shipping costs per ounce.

Both serve different purposes in a balanced portfolio. Silver coins offer better liquidity, easier authentication, and potential numismatic value but carry higher premiums (10-20%). Silver bars provide the lowest cost per ounce (3-8% premiums) but may be harder to sell quickly. Most investors use a mix: 40% government coins for liquidity, 40% bars for efficiency, and 20% junk silver for small transactions.

Most states now exempt precious metals from sales tax, recognizing them as investment assets. States still charging tax include California, Minnesota, Wisconsin, and a few others. Some states have minimum purchase exemptions (like $1,000+). You can legally avoid tax by: buying in tax-free states, meeting minimum thresholds, purchasing through dealers in tax-free states who ship to you, or buying for IRA accounts.

Beginners should start with widely recognized, liquid products: American Silver Eagles for ultimate liquidity despite higher premiums, Canadian Silver Maple Leafs for better value with security features, or 10 oz silver bars for the best balance of low premiums and manageable size. Avoid numismatic coins, proof coins, or obscure private mints until you understand the market better.

Reasonable premiums vary by product type: Generic rounds (5-10% over spot), Government coins like Eagles (15-20% over spot), 10 oz bars (3-8% over spot), 100 oz bars (2-5% over spot), and Junk silver (10-15% over melt value). During high demand, premiums can spike significantly. Always compare multiple dealers and be suspicious of premiums over 25% for common bullion products.

Online dealers typically offer lower premiums due to volume and lower overhead, plus better selection and 24/7 ordering. Local coin shops provide immediate possession, no shipping risks, cash transaction privacy, and the ability to inspect before buying. Many investors use both: online for bulk purchases and competitive pricing, local for small immediate needs or selling back. Always verify dealer reputation regardless of channel.

Yes, but specific rules apply. IRA-eligible silver must be .999 fine (American Eagles exempted), stored at approved depositories (not at home), purchased through IRA-approved dealers, and held by qualified custodians. Popular IRA silver includes American Eagles, Canadian Maple Leafs, and approved bars. Costs include custodian fees ($100-300/year) and storage fees ($100-300/year), making IRAs practical for positions over $10,000.

Basic tests anyone can perform: Magnet test (silver isn't magnetic), weight check (1 oz = 31.1 grams exactly), dimension verification with calipers, ice test (silver melts ice rapidly), and sound test (distinctive ring). For valuable purchases, consider electronic testers ($200-500) or professional verification. Buy from reputable dealers to minimize counterfeit risk—they test everything and guarantee authenticity.

While timing markets perfectly is impossible, historical patterns show summer months (May-August) often see lower prices due to reduced investment demand. The gold/silver ratio above 80:1 historically signals silver undervaluation. Rather than trying to time perfectly, most successful investors dollar-cost average with regular monthly purchases. With silver's volatility, patient accumulation beats speculation for long-term wealth building.

No reporting is required when buying silver in any amount. When selling, dealers must report only specific large transactions: 1,000 oz silver bars, $10,000+ cash payments, or 90% silver coins totaling $1,000+ face value sold at once. American Silver Eagles are exempt from reporting regardless of quantity. Keep good records for tax purposes, as capital gains apply when selling at a profit.

Silver coins are government-minted with face values and legal tender status (American Eagles, Canadian Maple Leafs), commanding higher premiums but offering superior liquidity. Silver rounds are privately minted medallions with no face value, offering lower premiums but slightly less liquidity. Both contain the same silver content—the choice depends on whether you prioritize cost (rounds) or recognition (coins).

Financial advisors typically recommend 5-20% of investment portfolios in precious metals, with silver comprising 60-70% of the metals allocation. For beginners, targeting 100 ounces provides meaningful exposure (~$3,600 current value). Some investors follow the "1% rule"—silver equal to 1% of net worth. Crisis-focused preppers often target 500-1,000 ounces. Start small and build based on your comfort level and financial situation.

Ready to Start Your Silver Investment Journey?

With silver experiencing its strongest fundamentals in decades—historic supply deficits, exploding industrial demand, and investment interest at multi-year highs—now is the time to take action. Whether you're drawn to the prestige of American Silver Eagles, the value of 10 oz silver bars, or the affordability of silver rounds, your journey to financial security begins with that first ounce.

Questions? Our precious metals specialists are available to guide you through your first purchase with zero pressure and complete transparency.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Precious metals investments involve risk, including potential loss of principal. Past performance does not guarantee future results. Always conduct thorough research and consult with qualified financial professionals before making investment decisions.