How To Buy Gold Coins: Ultimate Guide to Buying Gold Coins Like a Pro

How To Buy Gold Coins: The Ultimate 2025 Investment Guide

Master gold coin investing with expert strategies for navigating record-high gold prices and building wealth in uncertain times

By Gainesville Coins • Updated January 21, 2025

Quick Answer: How to Buy Gold Coins

To buy gold coins safely: Choose reputable dealers with transparent pricing, start with recognized bullion coins like American Gold Eagles or Canadian Maple Leafs, verify current gold spot prices, compare premiums across dealers, and store securely. With gold reaching record highs near $2,800 in 2025, timing and dealer selection are crucial for maximizing your investment.

Table of Contents

- Why Buy Gold Coins in 2025?

- Types of Gold Coins: Bullion vs. Numismatic

- Most Popular Gold Bullion Coins

- Historic Circulated Gold Coins

- Step-by-Step Buying Guide

- How to Choose Reputable Dealers

- Understanding Pricing and Premiums

- Storage and Security Options

- Gold Coin Investment Strategies

- Common Mistakes to Avoid

- Market Timing in 2025

- Frequently Asked Questions

Why Buy Gold Coins in 2025?

With gold prices reaching historic highs near $2,800 per ounce in 2025, understanding how to buy gold coins has never been more critical for protecting and growing wealth. Gold coins offer unique advantages over other forms of precious metals investing, combining the intrinsic value of gold with government backing, standardized weights, and global recognition.

🎯 Key Benefits of Gold Coins in 2025:

- Inflation Protection: With persistent inflation concerns, gold maintains purchasing power when fiat currencies decline

- Portfolio Diversification: Low correlation with stocks and bonds provides crucial balance

- Global Liquidity: Recognized worldwide, easily bought and sold in any major market

- No Counterparty Risk: Physical ownership eliminates dependence on financial institutions

- Privacy: Can be held anonymously without reporting requirements under $10,000

- Generational Wealth: Easily passed to heirs without complex estate planning

The current economic landscape makes gold coins particularly attractive. Central banks worldwide continue aggressive gold purchasing, with 2024 seeing record institutional demand. This "smart money" movement signals confidence in gold's long-term value proposition. Additionally, geopolitical tensions, dedollarization efforts, and concerns about government debt levels drive both institutional and retail investors toward physical gold.

Before making any purchase decision, it's essential to check the current gold spot price to understand market conditions and ensure you're getting fair value. Gold's volatility can create both opportunities and risks, making timing and dealer selection crucial factors in your investment success.

Types of Gold Coins: Understanding Bullion vs. Numismatic

When learning how to buy gold coins, the first crucial distinction is understanding the difference between bullion coins and numismatic (collectible) coins. This knowledge directly impacts your investment returns and liquidity.

Gold Bullion Coins

Bullion coins are minted specifically for investors and trade primarily based on their gold content plus a small premium. These modern coins offer the most straightforward way to invest in physical gold:

| Characteristic | Bullion Coins | Numismatic Coins |

|---|---|---|

| Premium Over Spot | 3-8% typically | 20-200%+ possible |

| Liquidity | Very high, global market | Limited to collectors |

| Price Volatility | Follows gold spot price | Subject to collector trends |

| Authentication | Standardized, easy | Requires expertise |

| Best For | Investors, wealth preservation | Collectors, speculation |

For most investors, bullion coins provide the optimal combination of low premiums, high liquidity, and straightforward valuation. You'll know exactly what your coins are worth at any time by checking the live gold price and adding the typical premium for your specific coins.

Semi-Numismatic Coins

A middle category exists with coins like pre-1933 U.S. gold pieces that carry modest collector premiums while still tracking gold prices closely. These offer some collectible appeal without excessive premiums, making them attractive to investors who appreciate historical significance.

Most Popular Gold Bullion Coins for Investors

When you're ready to buy gold, starting with internationally recognized bullion coins ensures maximum liquidity and fair pricing. Here are the top choices for 2025:

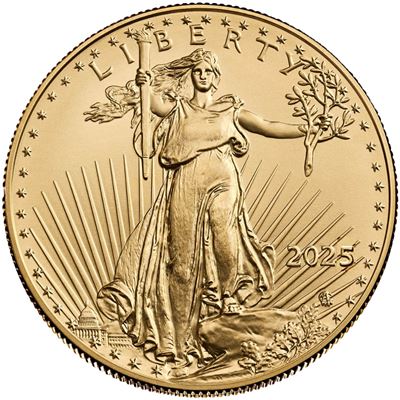

American Gold Eagle

The American Gold Eagle remains the world's most traded gold bullion coin. Its 22-karat composition adds copper and silver for durability, making it ideal for long-term storage. The U.S. government guarantees weight, content, and purity, providing unmatched security for investors.

Key Investment Benefits:

- ✓ Most liquid gold coin globally

- ✓ IRA-eligible for retirement accounts

- ✓ Available in 1 oz, 1/2 oz, 1/4 oz, and 1/10 oz

- ✓ New 2021 reverse design adds collectible appeal

Canadian Gold Maple Leaf

The Canadian Gold Maple Leaf pioneered the 99.99% purity standard in 1979. The Royal Canadian Mint's advanced security features, including radial lines and micro-engraving, make these coins virtually impossible to counterfeit.

Why Choose Maple Leafs:

- ✓ Highest purity standard (99.99%)

- ✓ Advanced anti-counterfeiting technology

- ✓ Often lower premiums than Eagles

- ✓ Recognized in all global markets

South African Krugerrand

The South African Krugerrand holds the distinction of being the world's first modern gold bullion coin. Since 1967, it has maintained its position as one of the most traded gold coins globally, with over 60 million ounces minted.

Krugerrand Advantages:

- ✓ Often lowest premiums among major bullion coins

- ✓ Durable 22-karat alloy resists scratching

- ✓ No face value = no reporting requirements

- ✓ Deep secondary market ensures liquidity

Other Notable Bullion Coins

While the above three dominate the market, several other excellent options deserve consideration:

- Austrian Gold Philharmonic: Europe's best-selling gold coin, 99.99% pure, features Vienna Philharmonic instruments

- British Gold Britannia: 99.99% pure since 2013, features advanced security, no capital gains tax for UK residents

- Australian Gold Kangaroo: Annual design changes add collectible appeal, 99.99% pure, from Perth Mint

- Chinese Gold Panda: Changing designs create numismatic premiums, 99.9% pure, gaining international recognition

- Mexican Gold Libertad: Limited mintages, beautiful design, available in multiple sizes

Historic Circulated Gold Coins: Combining History with Investment

For investors seeking gold coins with historical significance, pre-1933 U.S. gold pieces offer a unique opportunity. These coins circulated as actual currency before President Roosevelt's gold confiscation order, making them tangible pieces of American monetary history.

$20 Saint-Gaudens Double Eagle

The $20 Saint-Gaudens Double Eagle is widely considered America's most beautiful coin. President Theodore Roosevelt personally commissioned sculptor Augustus Saint-Gaudens to create this masterpiece, elevating U.S. coinage to an art form.

Investment Highlights:

- ✓ Nearly 1 oz of gold content (0.9675 oz)

- ✓ Survived 1933 gold confiscation as "collectibles"

- ✓ Lower premiums than modern bullion in some grades

- ✓ Potential for numismatic appreciation

- ✓ No reporting requirements for transactions

Other Historic U.S. Gold Coins

$20 Liberty Double Eagle (1849-1907)

Predecessor to the Saint-Gaudens, contains same 0.9675 oz gold. Features Liberty wearing coronet, available in various grades.

$10 Indian Head Eagle (1907-1933)

Contains 0.48375 oz gold, unique incuse design. Smaller denomination offers more affordable entry point.

$10 Liberty Eagle (1838-1907)

Long-running series with 0.48375 oz gold. Common dates available near melt value in circulated grades.

$5 Indian Head Half Eagle (1908-1929)

Contains 0.24187 oz gold, same unique incuse design as $10 Indian. Perfect for smaller investments.

When considering historic coins, remember that while they offer historical appeal and survived confiscation, they require more knowledge to buy and sell effectively. Stick to common dates in lower grades (VF-AU) for the best balance of history and value. For pure investment purposes, modern bullion coins typically offer better liquidity and tighter spreads.

Step-by-Step Guide: How to Buy Gold Coins Like a Pro

Follow this comprehensive process to ensure you make informed decisions and get the best value when purchasing gold coins:

Define Your Investment Goals

Before buying, clarify your objectives:

- Wealth Preservation: Focus on low-premium bullion coins like Gold Eagles or Maple Leafs

- Portfolio Diversification: Allocate 5-15% to gold, using recognized coins

- Speculation: Consider semi-numismatic coins with appreciation potential

- Emergency Fund: Stick to highly liquid 1 oz bullion coins

Research Current Market Conditions

Always check the current gold spot price before shopping. Understanding these factors helps time your purchase:

- Daily price movements and trends

- Premium levels for different coins

- Seasonal patterns (often lower in summer)

- Economic indicators affecting gold

Choose Your Coin Type and Size

Select coins based on your budget and goals:

Find and Verify Reputable Dealers

Look for dealers with:

- Transparent pricing showing premiums over spot

- Published buy-back prices

- Industry affiliations and certifications

- Physical location and established history

- Positive customer reviews and testimonials

- Clear shipping and return policies

Compare Prices and Premiums

Shop multiple dealers to find the best value:

- Calculate total cost including shipping and insurance

- Compare premiums as percentages, not just dollar amounts

- Check for volume discounts on larger purchases

- Consider payment method discounts (wire vs. credit card)

Place Your Order

When ready to buy:

- Lock in prices during market hours for best rates

- Understand the dealer's pricing mechanism (spot + premium)

- Confirm all fees before finalizing

- Get order confirmation with locked prices

- Choose insured shipping for all orders

Receive and Verify Your Coins

Upon delivery:

- Inspect packaging before signing

- Verify coins match your order exactly

- Check for authenticity (weight, dimensions, sound)

- Document receipt with photos

- Store securely immediately

💡 Pro Tip: Dollar-Cost Averaging

Rather than trying to time the market perfectly, consider purchasing gold coins regularly (monthly or quarterly). This dollar-cost averaging approach smooths out price volatility and builds your position steadily over time. Many dealers offer accumulation programs with reduced premiums for regular buyers.

How to Choose Reputable Gold Coin Dealers

Selecting the right dealer is crucial for ensuring authenticity, fair pricing, and professional service. The gold coin market includes many reputable businesses, but also some operators who overcharge inexperienced buyers.

Essential Dealer Credentials

Business Verification

Confirm:

- Physical business address

- Years in operation (5+ preferred)

- State licensing where required

Market Presence

Established dealers have:

- Published buy/sell prices

- Educational content

- Market commentary

Red Flags to Avoid

⚠️ Warning Signs of Problematic Dealers:

- High-pressure sales tactics: "Limited time offers" or "act now" pressure

- Unrealistic claims: Promises of guaranteed profits or "insider information"

- Opacity on pricing: Won't disclose premiums or total costs upfront

- No buyback policy: Legitimate dealers buy back what they sell

- Minimum purchase requirements: Forcing large initial investments

- Bait and switch: Advertising one product but pushing expensive alternatives

- Excessive premiums: Charging 20%+ over spot for common bullion

Online vs. Local Dealers

Both channels have advantages depending on your priorities:

| Factor | Online Dealers | Local Coin Shops |

|---|---|---|

| Pricing | Generally lower premiums due to volume | Higher premiums but negotiable |

| Selection | Vast inventory, all products available | Limited to current stock |

| Convenience | 24/7 shopping, delivered to door | Immediate possession, no shipping |

| Privacy | Shipping records exist | Cash transactions possible |

| Verification | Must trust dealer reputation | Can inspect before buying |

Many investors use both channels strategically: online for bulk purchases and competitive pricing, local dealers for smaller transactions and immediate needs. Whichever you choose, always compare prices from multiple sources before committing to ensure you're getting fair market value.

Storage and Security Options for Gold Coins

Once you've purchased gold coins, proper storage becomes critical. Your storage solution should balance security, accessibility, and cost while protecting your investment from theft, damage, and discovery.

Home Storage Options

Security Best Practices

🔒 Essential Security Rules:

- ✓ Never publicize your gold ownership on social media

- ✓ Avoid telling friends, family, or neighbors about holdings

- ✓ Use discrete packaging when receiving shipments

- ✓ Vary your routines when accessing storage

- ✓ Document coins with photos for insurance

- ✓ Consider dividing holdings across multiple locations

- ✓ Keep detailed inventory records (stored separately)

- ✓ Review insurance coverage limits and exclusions

Remember that gold coins are compact stores of significant value. A single tube of 20 one-ounce coins worth $56,000+ can fit in your pocket. This portability is advantageous but demands serious security consciousness. The first rule of gold ownership is discretion—the fewer people who know about your holdings, the safer they remain.

Gold Coin Investment Strategies for 2025

Successful gold coin investing requires more than just buying and holding. Understanding different strategies helps optimize returns while managing risk in today's volatile markets.

Core Investment Approaches

1. Buy and Hold (Long-term Wealth Preservation)

The classic approach for investors seeking protection against currency debasement and economic uncertainty.

- Time Horizon: 5+ years minimum

- Best Coins: Low-premium bullion like Gold Eagles, Maple Leafs

- Allocation: 5-15% of total portfolio

- Advantages: Simple, no timing required, historically effective

This strategy particularly suits investors concerned about long-term dollar weakness, inflation, or systemic financial risks.

2. Dollar-Cost Averaging (Systematic Accumulation)

Regular purchases regardless of price smooth out volatility and build positions methodically.

- Frequency: Monthly or quarterly purchases

- Amount: Fixed dollar amount each period

- Benefits: Removes emotion, captures all price points

- Example: $500/month buys varying amounts as prices fluctuate

Many dealers offer accumulation programs with reduced premiums for committed regular buyers.

3. Ratio Trading (Gold/Silver Switching)

Exchange between gold and silver based on their historical price ratio to increase total ounces.

- Current Ratio: ~80:1 (80 oz silver = 1 oz gold)

- Historical Average: ~60:1

- Strategy: Trade gold for silver when ratio is high (80+)

- Reverse: Trade silver for gold when ratio is low (40-50)

Over long periods, this strategy can significantly increase holdings without adding new capital. Consider the tax implications and dealer premiums when executing trades.

4. Premium Arbitrage

Buy coins when premiums are low, potentially sell when premiums spike during high demand.

- Monitor: Premium percentages across different coins

- Buy: When premiums compress (3-4% for Eagles)

- Consider Selling: When premiums expand (8%+ for Eagles)

- Risk: Requires active monitoring and timing

This advanced strategy works best during volatile markets when supply/demand imbalances create premium disparities.

Portfolio Integration Strategies

Gold coins should complement, not dominate, a diversified investment portfolio. Consider these allocation frameworks:

Conservative Portfolio (Capital Preservation Focus)

Moderate Portfolio (Balanced Growth)

Remember to rebalance periodically. If gold significantly outperforms and grows to 20% of your portfolio, consider selling some to maintain target allocation. This disciplined approach forces "sell high, buy low" behavior. For deeper insights on precious metals investing, explore silver investment options as a complement to gold holdings.

Common Mistakes to Avoid When Buying Gold Coins

Learning from others' errors can save you thousands of dollars and years of frustration. Here are the most costly mistakes new gold investors make:

❌ Mistake #1: Buying Numismatic Coins as Investments

Many dealers push rare coins with huge premiums (50-200% over melt value) to inexperienced buyers. Unless you're a knowledgeable collector, these coins often underperform bullion.

❌ Mistake #2: Trying to Time the Market Perfectly

Waiting for the "perfect" entry point often results in missing opportunities entirely. Gold can move $100+ per ounce in days during volatile periods.

❌ Mistake #3: Overpaying Due to Poor Research

Some buyers pay 20-30% premiums for common bullion coins that should trade at 5-7% over spot. This immediately puts them at a significant loss.

❌ Mistake #4: Neglecting Storage and Security

Keeping valuable coins in dresser drawers or discussing holdings publicly invites theft. Poor storage also risks damage that reduces value.

❌ Mistake #5: Falling for High-Pressure Sales Tactics

"Limited time offers" and "exclusive deals" pressure buyers into poor decisions. Legitimate dealers don't use these tactics.

❌ Mistake #6: Ignoring Tax Implications

Gold coins are taxed as collectibles at 28% federal rate for long-term gains. Some investors are surprised by tax bills after selling.

❌ Mistake #7: Buying from Questionable Sources

Online marketplaces, classified ads, and unknown dealers carry significant risks of counterfeits or unfair pricing.

The common thread in these mistakes is acting hastily without proper education. Take time to understand the market, establish relationships with reputable dealers, and develop a clear investment strategy before making significant purchases. When you're ready to diversify beyond gold, research silver bullion options which often provide higher volatility and potential returns.

Market Timing Considerations for 2025

While perfect market timing is impossible, understanding current conditions and historical patterns helps make more informed buying decisions.

Current Market Drivers (2025)

🟢 Bullish Factors

- Central bank gold buying at record levels

- Persistent inflation above target rates

- Geopolitical tensions and deglobalization

- U.S. debt exceeding $34 trillion

- Dollar alternatives being developed globally

- Mining supply constraints increasing

🔴 Bearish Factors

- Higher interest rates competing with gold

- Cryptocurrency adoption by institutions

- Technical resistance at record levels

- Potential recession reducing demand

- Strong dollar periods pressuring prices

Historical Price Patterns

While past performance doesn't guarantee future results, gold exhibits some seasonal tendencies:

Typical Annual Pattern:

- January-February: Often strong as investors position for new year

- March-April: Can see profit-taking after Q1 gains

- May-August: Traditional summer weakness, good accumulation period

- September-December: Historically strongest period, holiday/festival demand

Key Indicators to Monitor

Track these metrics for potential buying opportunities:

Real Interest Rates

Negative real rates (inflation minus bond yields) typically support gold prices

Dollar Index (DXY)

Gold often moves inversely to dollar strength

Gold/S&P 500 Ratio

Historical lows may signal undervaluation

Central Bank Purchases

Continued buying supports long-term demand

Mining Production Costs

All-in costs near $1,200/oz provide price floor

Technical Levels

Watch support/resistance for entry points

Rather than attempting to predict short-term movements, focus on gold's role in your long-term financial plan. Dollar-cost averaging remains the most reliable approach for building positions without the stress of timing decisions. Monitor silver prices as well, as the gold/silver ratio can present opportunities for maximizing ounces through strategic trading.

Frequently Asked Questions About Buying Gold Coins

You can start with as little as $300-400 for a 1/10 oz gold coin. Popular options include 1/10 oz American Gold Eagles or Canadian Maple Leafs. While smaller coins carry higher premiums (10-15%), they provide an affordable entry point and are highly liquid. Many investors start with fractional coins and gradually work up to full ounces as their budget allows.

Gold coins typically offer better liquidity, easier authentication, and legal tender status, making them ideal for most investors. Coins like American Gold Eagles are instantly recognizable worldwide. Gold bars offer slightly lower premiums (2-4% vs 4-7%) but may be harder to sell quickly and require assay certificates. For investments under 10 ounces, coins are generally preferable. Larger investors might mix both for optimal pricing.

Sales tax on gold coins varies by state. As of 2025, 42 states exempt investment-grade gold coins from sales tax, recognizing them as monetary instruments rather than collectibles. States still charging tax include California, Kentucky, Maine, Minnesota, New Jersey, Vermont, and Wisconsin. Some have minimum purchase exemptions (e.g., over $1,000). Always verify current laws in your state before purchasing.

Verify authenticity through multiple methods: Check exact weight (should match specifications within 0.1%), measure dimensions with calipers, perform the "ping test" for proper sound, use a strong magnet (gold isn't magnetic), and consider electronic testers for larger collections. Buy from reputable dealers to minimize risk. Modern coins like Maple Leafs include security features like micro-engraving that make counterfeiting extremely difficult.

The 1 oz American Gold Eagle is ideal for beginners due to its unmatched liquidity, U.S. government backing, and global recognition. Canadian Gold Maple Leafs offer a close second with lower premiums and higher purity (99.99% vs 91.67%). Both are IRA-eligible and widely traded. Start with 1 oz coins for best value, or 1/10 oz if budget is limited. Avoid rare/collectible coins until you gain experience.

Yes, specific gold coins are IRA-eligible including American Gold Eagles, Canadian Maple Leafs, Austrian Philharmonics, and Australian Kangaroos. The IRS requires minimum 99.5% purity (Eagles are specifically exempted despite being 91.67%). You'll need a self-directed IRA with an approved custodian and depository storage. Annual contribution limits apply, and you cannot take physical possession while in the IRA.

The best time is when you have disposable income and understand gold's role in your portfolio. Historically, summer months (June-August) often see lower prices due to reduced demand. However, timing the market perfectly is nearly impossible. Dollar-cost averaging—buying fixed amounts regularly—removes timing stress and builds positions systematically. Focus on your long-term goals rather than short-term price movements.

Selling options include: dealers (often pay 95-98% of spot for bullion), local coin shops (immediate payment but lower prices), online dealers (competitive prices but shipping required), auction houses (for rare coins), and private sales (highest risk). Always get multiple quotes. Dealers who sold to you should buy back at fair prices. Expect to net 2-5% below spot price for common bullion coins in normal markets.

No reporting is required for buying gold coins in any amount. When selling, dealers must report only specific transactions: 25+ ounces of Krugerrands, Maple Leafs, or Mexican Onzas sold at once, or any sale over $10,000 cash. American Gold Eagles are exempt from reporting regardless of quantity. State laws may vary. Keep good records for tax purposes, as gains are taxable.

Bullion coins are struck once with standard dies for investors, carrying low premiums (3-7%). Proof coins are struck multiple times with polished dies creating mirror-like fields and frosted designs for collectors, with premiums of 15-40%+. While beautiful, proof coins are poor investments due to high premiums rarely recovered when selling. Stick to bullion versions unless collecting for enjoyment rather than investment.

Ready to Start Your Gold Investment Journey?

Now that you understand how to buy gold coins like a professional investor, take the next step toward securing your financial future. Whether you're drawn to the iconic American Gold Eagle, the pure Canadian Maple Leaf, or the historic Krugerrand, starting your collection begins with choosing a trusted dealer.

Questions? Our precious metals experts are available to guide you through your first purchase with no pressure or obligations.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Precious metals investments involve risk, and past performance does not guarantee future results. Always conduct thorough research and consult with qualified financial professionals before making investment decisions.