1 oz COMEX Approved Gold Bar With Assay Certificate .9999 Fine - (Various Brand and Design)

| Qty | Check / Bank Wire |

Crypto

We are now accepting Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), Dai (DAI), and USD Coin (USDC) as a payment method on our website!

|

Credit Card |

|---|---|---|---|

| 1+ | $5,204.46 | $5,308.55 | $5,386.62 |

Buy 1 oz COMEX Approved Gold Bar With Assay Certificate .9999 Fine - (Various Brand and Design)

Buy COMEX Approved Gold Bars at Gainesville Coins

Gainesville Coins is proud to offer the 1 oz COMEX Approved Gold Bar With Assay Certificate (.9999 Fine)!

Although coins and jewelry remain popular vehicles for gold bullion, the most common type of gold investment remains the 24-karat gold bar, also known as an ingot.

These bars are the most efficient way to store gold in a small space, making them the ideal form for people who store gold in vaults or trade physical gold on the international markets.

In fact, all of these .9999 fine, 1 oz gold bars are COMEX-approved, meaning they meet the specifications put forth by the official Commodities Exchange division of the New York Mercantile Exchange (NYMEX), run by the Chicago Mercantile Exchange (CME) Group.

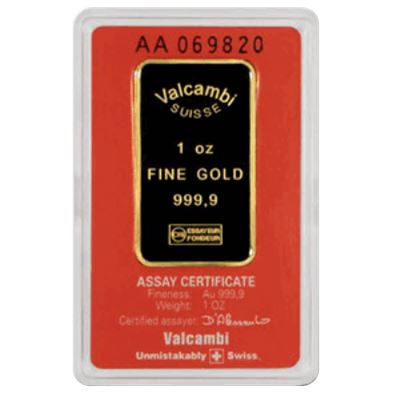

The bar you receive may come from a variety of different refiners, or brands. This includes, but is not limited to, gold bars from Valcambi, Credit Suisse, PAMP Suisse, the Royal Canadian Mint, and the Perth Mint.

Each bar is at least .9999 fine gold, and contains 1 troy oz of pure gold content. The bar you receive will also be accompanied by its own assay certificate, certifying its authenticity and weight & purity specifications, in addition to finding these values stamped on the face of the bar.

If you're interested in adding pure gold bullion to your holdings but want the added assurance of one of the world's most trusted brands, then the 1 oz COMEX Approved Gold Bar With Assay Certificate (.9999 Fine) is the perfect addition! Get yours from Gainesville Coins today for competitive pricing!

This is a stock photo only. The design of the bar may vary and the listing is for quantity (1) 1 oz COMEX Gold Bar

Specification

Related Products

Customer Ratings & Review

Review This Product

Share your thoughts with other customers.