The Ultimate Gold Investment Guide From Beginner To Advanced

The Ultimate Gold Investment Guide

Your Complete 2025 Roadmap to Investing in Gold

Quick Answer: How to Invest in Gold in 2025

The most effective gold investment strategy combines physical ownership (coins/bars) for wealth preservation with gold ETFs for liquidity and trading flexibility. Start with a 5-10% portfolio allocation, focusing on government-minted coins like American Gold Eagles or low-cost ETFs. With gold at record highs in 2025, dollar-cost averaging helps manage entry timing while Basel III regulations strengthen gold's role in the global financial system.

📊 2025 Gold Market Update

$3,432.24/oz

Key Driver: Basel III now classifies gold as Tier 1 capital for banks, driving unprecedented institutional demand. Track live gold prices to time your investments.

What You'll Learn

Why Gold Matters in 2025's Economy

Gold has surged to record highs in 2025, driven by three unprecedented factors that are reshaping the global financial landscape. Understanding these drivers is crucial for making informed investment decisions.

Basel III: Gold Becomes "Tier 1" Money

The July 1, 2025 Basel III deadline marks a historic shift in how banks value gold. For the first time since the gold standard ended in 1971, gold is officially classified as a zero-risk Tier 1 capital asset, equal to cash and government bonds. This means banks can now hold physical gold at 100% value on their balance sheets, compared to the previous 50% haircut.

This regulatory change has triggered massive institutional buying, with central banks purchasing over 1,000 tonnes annually – the highest level in decades. For individual investors, this means increased competition for physical gold and sustained price support.

Inflation Protection in the Modern Era

While inflation has moderated from 2022 peaks, the cumulative effect remains significant. Gold has historically preserved purchasing power over long periods, and with global debt at record levels, currency debasement risks persist. Smart investors are using gold to hedge against both visible inflation and the hidden tax of currency depreciation.

💡 Investment Insight

Gold's 26% gain in 2025 outpaces both stocks and bonds, validating its role as a portfolio diversifier. Even a modest 5-10% allocation can significantly reduce overall portfolio volatility while potentially enhancing returns.

Before diving into specific investment options, it's essential to understand that current gold prices reflect both monetary and geopolitical uncertainties. The combination of central bank buying, Basel III implementation, and persistent global tensions creates a uniquely supportive environment for gold investments.

6 Ways to Invest in Gold (Compared)

Not all gold investments are created equal. Each option offers distinct advantages and trade-offs in terms of cost, liquidity, and ease of ownership. Here's a comprehensive breakdown to help you choose the right approach:

| Investment Type | Minimum Investment | Liquidity | Annual Costs | Best For |

|---|---|---|---|---|

| Physical Gold Coins | ~$200 (1/10 oz) | High | Storage only | Long-term holders, crisis hedge |

| Gold Bars | ~$70 (1 gram) | Moderate | Storage only | Bulk purchases, cost efficiency |

| Gold ETFs | ~$20 (1 share) | Excellent | 0.25-0.40% | Active traders, IRAs |

| Gold Mining Stocks | Varies | Excellent | None | Growth seekers, dividends |

| Gold Futures | ~$10,000 margin | High | Roll costs | Advanced traders only |

| Digital Gold | ~$1 | Good | 0.5-1% | Tech-savvy, micro investing |

Physical Gold: The Foundation

Physical gold remains the cornerstone of precious metals investing. When you buy physical gold, you own a tangible asset with no counterparty risk. Government-minted coins like American Gold Eagles offer the best liquidity, while bars provide the most gold for your dollar.

Gold ETFs: Convenience and Liquidity

Exchange-traded funds tracking gold prices offer stock-like liquidity without storage concerns. Popular options include SPDR Gold Shares (GLD) and iShares Gold Trust (IAU). While convenient, remember that ETFs carry expense ratios and don't provide the same crisis protection as physical ownership.

⚠️ Tax Alert

Both physical gold and gold ETFs are taxed as collectibles at a 28% long-term capital gains rate. Gold mining stocks, however, qualify for standard capital gains treatment (0-20% based on income).

Gold Coins vs. Bars: Which is Better?

The choice between coins and bars represents one of the most important decisions for physical gold investors. Each format serves different investment objectives and offers unique advantages.

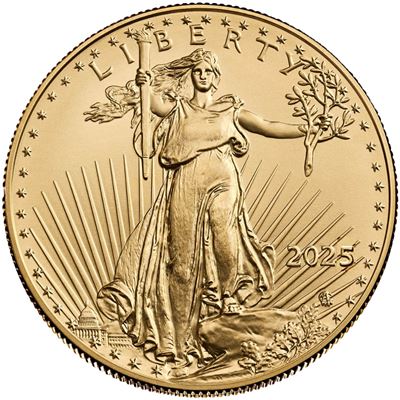

American Gold Eagle (1 oz)

- ✓ Most liquid gold coin globally

- ✓ Legal tender status

- ✓ 91.67% pure (22 karat)

- ✓ IRA eligible

Best for: First-time buyers seeking maximum liquidity and recognition.

View American Gold Eagle

1 oz COMEX Gold Bar

- ✓ Lower premium vs coins

- ✓ 99.99% pure gold

- ✓ COMEX approved

- ✓ Includes assay certificate

Best for: Cost-conscious investors prioritizing maximum gold content.

View COMEX Gold BarKey Differences at a Glance

- Premiums: Coins typically carry 3-8% premiums over spot price, while bars often have 1-3% premiums

- Liquidity: Government coins are instantly recognizable worldwide; bars may require authentication

- Divisibility: Coins come in fractional sizes (1/10, 1/4, 1/2 oz); bars are less flexible

- Storage: Coins stack efficiently; larger bars may require special storage considerations

For most investors, a combination works best: coins for liquidity and emergency preparedness, bars for bulk wealth storage. Start with recognized coins like American Eagles or Canadian Maple Leafs, then add bars as your holdings grow. Always check current spot prices before purchasing to ensure fair premiums.

Getting Started: Entry-Level Gold Investments

Starting your gold investment journey doesn't require substantial capital. Today's market offers numerous entry points for investors at every level, from fractional coins to micro-investment platforms.

Best Options for Beginners

1 Gram Gold Bar

- ✓ Lowest entry price (~$70)

- ✓ Perfect for monthly accumulation

- ✓ PAMP/Credit Suisse quality

- ✓ Gift-ready packaging

Ideal for: Budget-conscious beginners building positions gradually.

Start with 1 Gram

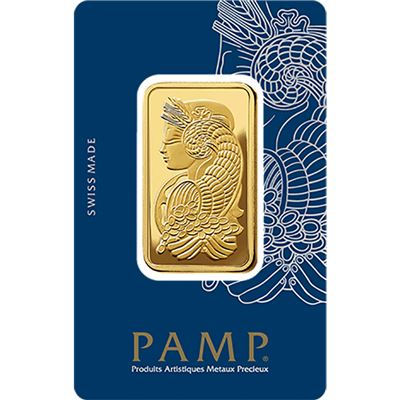

PAMP Suisse 1 oz (Fortuna)

- ✓ World's most recognized bar

- ✓ Artistic Fortuna design

- ✓ Individual assay certificate

- ✓ Premium resale value

Ideal for: Investors seeking premium brands with maximum resale appeal.

View PAMP FortunaDollar-Cost Averaging Strategy

Rather than trying to time the market, consider a systematic approach:

- Set a monthly budget: Even $100-200 monthly can build meaningful holdings over time

- Choose your format: Fractional coins for flexibility or small bars for efficiency

- Buy consistently: Purchase on the same day each month regardless of price

- Track your average cost: This smooths out price volatility over time

📈 Beginner's Tip

Start with gold ETFs in your retirement account for tax efficiency, then add physical gold for direct ownership. A balanced approach provides both convenience and security. Consider silver investments once you're comfortable with gold – the gold-to-silver ratio currently favors silver accumulation.

Portfolio Allocation & Strategy

Determining the right gold allocation depends on your age, risk tolerance, and investment objectives. While traditional advice suggests 5-10%, recent academic studies indicate optimal allocations may be higher.

Research-Based Allocation Guidelines

- Conservative investors (capital preservation focus): 10-15% gold allocation

- Balanced investors (growth with protection): 5-10% gold allocation

- Aggressive investors (maximum growth): 3-5% gold allocation

- Crisis preparation: Consider 15-20% during uncertain times

Studies by the World Gold Council demonstrate that portfolios with 5-10% gold allocation have historically shown better risk-adjusted returns than those without gold. The key is maintaining your target allocation through regular rebalancing.

Sample Portfolio Allocations by Age

| Age Group | Stocks | Bonds | Gold | Cash |

|---|---|---|---|---|

| 20-35 (Growth) | 70% | 20% | 5% | 5% |

| 35-50 (Balanced) | 60% | 25% | 10% | 5% |

| 50-65 (Preservation) | 40% | 40% | 15% | 5% |

| 65+ (Income) | 30% | 50% | 10% | 10% |

Remember to monitor silver prices as well – many investors maintain a gold-to-silver allocation ratio of 70:30 within their precious metals holdings for additional diversification.

Tax Implications & Optimization

Understanding gold taxation is crucial for maximizing after-tax returns. The IRS classifies physical gold and most gold ETFs as "collectibles," resulting in less favorable tax treatment than traditional securities.

Current Tax Treatment (2025)

- Physical gold & gold ETFs: 28% maximum long-term capital gains rate

- Gold mining stocks: Standard capital gains rates (0%, 15%, or 20%)

- Short-term gains (under 1 year): Taxed as ordinary income for all gold investments

Tax-Smart Strategies

- Hold gold ETFs in IRAs: Avoid collectibles tax by using tax-advantaged accounts

- Consider mining stocks in taxable accounts: Benefit from lower capital gains rates

- Use losses strategically: Harvest losses to offset gains in other investments

- Gift appreciated gold: Transfer to heirs who may have lower tax brackets

⚠️ Reporting Requirements

Dealers must report cash purchases over $10,000 and certain bullion sales to the IRS. Maintain accurate records of all gold transactions, including purchase dates, amounts, and prices paid.

How to Buy Gold Safely

Purchasing gold requires due diligence to ensure authenticity and fair pricing. Whether buying online or in-person, follow these guidelines to protect your investment.

Essential Buying Checklist

- ✓ Verify dealer credentials and business history

- ✓ Compare prices to current spot gold prices

- ✓ Understand all fees including shipping and insurance

- ✓ Confirm buyback policies before purchasing

- ✓ Request certificates of authenticity for bars

- ✓ Use secure payment methods with fraud protection

Red Flags to Avoid

- ❌ Prices significantly below market rates

- ❌ High-pressure sales tactics or "limited time" offers

- ❌ Lack of transparent pricing on websites

- ❌ No physical address or phone number

- ❌ Requests for cryptocurrency or wire transfers only

Ready to Start Investing?

Browse our complete selection of investment-grade gold products with transparent pricing and secure delivery.

Shop Gold ProductsFrequently Asked Questions

You can start investing in gold with as little as $20-70. Options include:

- Gold ETF shares: Starting around $20 per share

- 1-gram gold bars: Approximately $70-80

- Fractional gold coins (1/10 oz): Around $200-250

- Digital gold platforms: Often allow $1 minimum investments

For physical gold, 1-gram bars offer the lowest entry point while maintaining investment-grade quality.

Gold presents compelling opportunities in 2025 due to several factors:

- Basel III implementation: Banks now value gold as Tier 1 capital

- Central bank buying: Record purchases exceeding 1,000 tonnes annually

- Geopolitical tensions: Ongoing conflicts increase safe-haven demand

- Currency concerns: High global debt levels support gold prices

However, gold should be part of a diversified portfolio, not a complete investment strategy. Most advisors recommend 5-15% allocation depending on your risk tolerance.

The choice depends on your investment goals:

Choose coins if you value:

- Maximum liquidity and recognition

- Easier authentication

- Fractional sizes for flexibility

- Potential numismatic appreciation

Choose bars if you prioritize:

- Lowest premiums over spot price

- Maximum gold per dollar spent

- Efficient storage of larger amounts

- Simple wealth preservation

Many investors combine both, using coins like American Gold Eagles for liquidity and bars for bulk storage.

Spot price is the current market price for immediate delivery of raw gold, constantly fluctuating based on global trading.

Retail price includes the spot price plus:

- Minting/fabrication costs

- Distribution expenses

- Dealer profit margins

- Market demand premiums

Typical premiums range from 2-5% for bars and 3-10% for coins. During high demand, premiums can spike significantly. Always check current spot prices before purchasing to ensure fair pricing.

Secure storage is crucial for physical gold investments:

Home storage options:

- High-quality safe (minimum TL-15 rating)

- Hidden locations (avoid master bedroom)

- Consider security system integration

Professional storage:

- Bank safe deposit boxes (verify insurance)

- Private vault storage facilities

- Allocated storage programs

Insurance considerations:

- Homeowner's policies often limit coverage

- Consider separate valuable items policy

- Document all purchases with photos

Start Your Gold Investment Journey Today

With gold at historic highs and Basel III reshaping the monetary system, now is the time to secure your financial future with precious metals.

Browse Gold ProductsDisclaimer: This article is for educational purposes only and should not be considered financial advice. Precious metals investments involve risk, and past performance does not guarantee future results. Always conduct thorough research and consult with qualified financial professionals before making investment decisions.